Meritage Portfolios®

Consistent performance in a volatile economy

Consult the Round Table

About

Launched in 2006, these Portfolios offer an objectively managed portfolio solution featuring mutual funds and exchange-traded funds (ETFs). The Meritage family provides 24 solutions designed to cater to any investor profile.

The success of Meritage depends on partnerships with renowned firms. These firms complement each other and are selected for their expertise and performance history.

Learn more about Meritage Tactical ETF Porfolios

Markets are constantly evolving and investors may want to take advantage of certain market conditions or protect themselves against certain risks. In such cases, it is useful to tactically deviate from the initially targeted asset allocation.

Value added

An optimal blend of some of the best low-cost ETFs on the market and tactically managed asset allocation based on market conditions.

Tactical asset allocation

Meritage ETF Portfolios undergo a review process during which the asset allocation and choice of underlying ETFs are subject to frequent change in order to reflect market conditions. The allocation of Meritage Portfolios is determined after consultation with the Asset Allocation Committee, which is made up of renowned economists and portfolio strategists within the National Bank group.

Currency management

NBI manages the currency exposure strategy.

Construction of Meritage Tactical Portfolios

The tactical biases we want to leverage are determined quaterly.

To adapt to the evolution of financial markets, certain deviations can be implemented by overweighting or underweighting the ETFs currently found in the Portfolios. These deviations seek to create added value for the Portfolios while helping mitigate short-term volatility.

Performance attribution is carried out each month to ensure optimal risk management.

Meritage Strategic Portfolios

Learn more about the Meritage Strategic Portfolios

Value added

An optimal blend of actively managed funds.

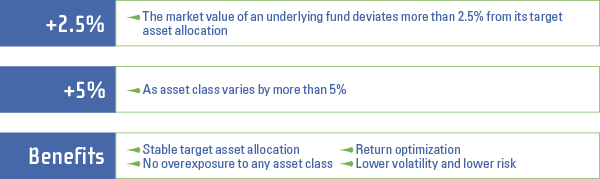

Automatic rebalancing

Meritage Portfolios are automatically rebalanced to respect their target allocation and prevent overexposure in any specific asset class. If the market value of a fund deviates more than 2.5% from its target allocation or an asset class varies by more than 5%, we will rebalance the Portfolio.

Currency management

The currency exposure strategy is managed by portfolio managers.

Construction of Meritage Strategic Portfolios

First, the objective of the Portfolio and the optimization factors are determined. Subsequently, NBI establishes potential range of returns, volatility and correlation for the main asset classes through consultation with economists and other experts.

With the investment objectives and quantitative parameters well established, we carry out optimization to maximize the risk/return ratio.

Once the optimal asset allocation is determined, we verify the results obtained in comparison to the expected returns and risk parameters of the underlying funds selected for the Portfolio.

Optimization is completed again each year to ensure the Portfolio's asset allocation remains optimal.

Meritage Global Portfolios

Conservative | Moderate | Balanced | Growth | Growth Plus

Meritage Income Portfolios

Diversified Fixed Income | Conservative | Moderate | Balanced | Growth | Growth Plus

Meritage Investment Portfolios

Conservative | Moderate | Balanced | Growth | Growth Plus

Meritage Equity Portfolios

Canadian | Global | International | American

Agile

Our open architecture structure allows us to work with some of the best portfolio managers from around the world.

Diligent

A three-stage selection process and in-depth analysis identifies the best mutual funds and ETFs on the market for each asset class.

Proactive

Continuous monitoring allows us to be prepared for any eventuality, such as a portfolio manager change.

Selection process

We have selected between 30 and 50 of the best mutual funds and ETFs on the market using our unique fund selection process. This multi-stage, quantitative selection process was developed by a financial engineering team of investment specialists. Updates and follow-ups are carried out periodically to ensure that the funds continuously meet the selection criteria and that the Portfolios remain optimal.

Screening process

Focus on proven funds

5,000 funds and 2,000 ETFs

- Minimum performance history

- Solid, well-established fund managers

Quantitative analysis

Seek added value with optimal volatility

200 to 400 funds and ETFs

- Returns by unit of risk analysis

- Downside risk analysis

- Value added by portfolio manager performance analysis

- Style consistency

- Correlation

Final selection

Make informed choices

20 to 30 funds and 10 to 20 ETFs working together to create the perfect combination

- Investment firm: quality of research, security selection process

- Manager: experience, philosophy, compensation, succession plan

- Management style: consistency and complementary-focused (value, blend, growth)

A range of portfolios

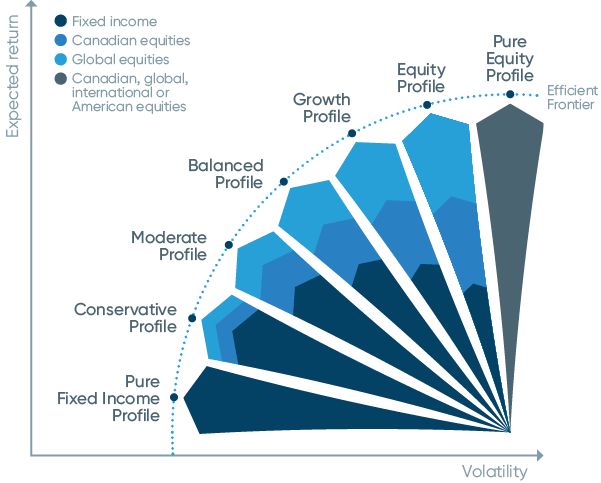

Meritage Portfolios provide a wide range of solutions, based on various criteria and suited for all types of investors. Regardless of your objectives, investment horizon and risk tolerance, there is a Meritage Portfolio that is suited for you.

Our Portfolios offer optimal exposure and diversification by asset class, geographic region and sector, market capitalization and management style, all within an integrated range of model portfolios.

Optimal diversification

Asset classes

- Bonds

- Equities (Canadian and foreign)

- Emerging markets

Management styles

- Value and deep value

- Blend

- Growth and GARP (growth at a reasonable price)

- Bottom-up

- Top-down

- Multiple fixed income strategies

Market capitalizations

- Small

- Mid

- Large

Regions/Sectors

- Optimal geographic and sector coverage

- No restrictions

Auto-rebalancing

Our approach

Meritage Equity, Investment, Income and Global Portfolios are automatically rebalanced when:

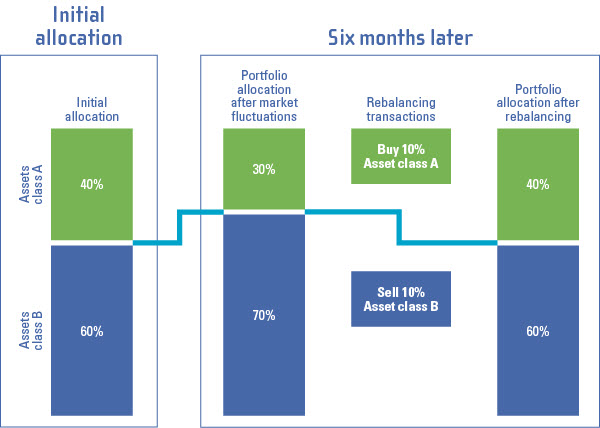

An example

Periodic rebalancing of a portfolio brings it back in line with its target asset allocation:

Tax-efficient distribution

How to benefit from a tax-efficient distribution?

Certain Meritage Portfolios are also offered as income portfolios to provide you with fixed monthly distributions1 made up, in part, of net income and

General information

General

- Why Meritage?

- Meritage Portfolios: Advisor presentation

- Brochure

- Summary table

- Meritage Portfolios at a glance

- NBI High Net Worth Plan

- Transition report

Performance

- Monthly performance: Advisor Series | F Series

- Meritage Portfolios: Percentiles

- Meritage Portfolios: Morningstar 4- and 5-star ratings

Distributions

- Meritage Portfolios: Estimated year-end distributions per unit

- Distributions paid by Meritage Portfolios (by unit)

Meritage Tactical ETF Portfolios

Outlook

Advisor material

General information

- Historical changes: Meritage Tactical ETF Portfolios | Meritage Strategic Portfolios

Investor Profile Questionnaire and Investment Policy Statement (IPS)

Investor Profile Questionnaire and Investment Policy Statement (IPS)

Meritage Portfolios provide a wide range of solutions, based on various criteria and suited for all types of investors. Regardless of your objectives, investment horizon and risk tolerance, there is a Meritage Portfolio that is right for you.

Investor Profile Questionnaire*

* FOR INFORMATION PURPOSES ONLY. This questionnaire is for information purposes only. It is not intended to replace a complete investment suitability analysis or to be considered as investment advice. It is intended solely as a reference document to assist investors in selecting the portfolio that best suits their investment needs. This questionnaire is not intended to replace any questionnaire required at the time of the purchase of securities, and at all times, the latter takes precedence.

Investment Policy Statement (IPS)

Questions?

Contact your NBI Sales Representative

1. The distribution is said to be fixed for each Meritage Income Portfolio as it does not vary from one distribution to the next. However, it is not guaranteed and may vary according to market conditions. Meritage Income Portfolios make monthly distributions at the end of each month. These monthly distributions are composed of net income and/or return of capital. For more information, please consult the simplified prospectus of Meritage Portfolios.

2. A return of capital reduces the value of the original investment and is not the same as the return on the investment. Returns of capital that are not reinvested may reduce the net asset value of the Portfolio and the Portfolio's subsequent ability to generate income.

The information and the data supplied on the current page of this site, including those supplied by third parties, are considered accurate at the time of their publication and were obtained from sources which we considered reliable. We reserve the right to modify them without advance notice. This information and data are supplied as informative content only. No representation or guarantee, explicit or implicit, is made as for the exactness, the quality and the complete character of this information and these data. The opinions expressed are not to be construed as solicitation or offer to buy or sell shares mentioned herein and should not be considered as recommendations.

Meritage Portfolios® (the “Portfolios”) are managed by National Bank Investments Inc., a wholly owned subsidiary of National Bank of Canada. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Portfolios before investing.

The Portfolios’ securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Portfolios are not guaranteed, their values change frequently and past performance may not be repeated.

® MERITAGE PORTFOLIOS and the Meritage Portfolios logo are registered trademarks of National Bank of Canada, used under licence by National Bank Investments Inc.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under licence by National Bank Investments Inc.

National Bank Investments is a signatory of the United Nations-supported Principles for Responsible Investment, a member of Canada’s Responsible Investment Association, and a founding participant in the Climate Engagement Canada initiative.