Using ESG factors as a strategic edge

ESG factors can be complex. But in the hands of skilled active managers, they can become a tool to anticipate risks, generate performance, and protect portfolios during market downturns.

Example: A Bloomberg study found that companies with strong safety records in mining and chemicals outperformed peers by 3.5% annually, while oil and gas firms with better environmental practices outperformed by 2.2%. 2

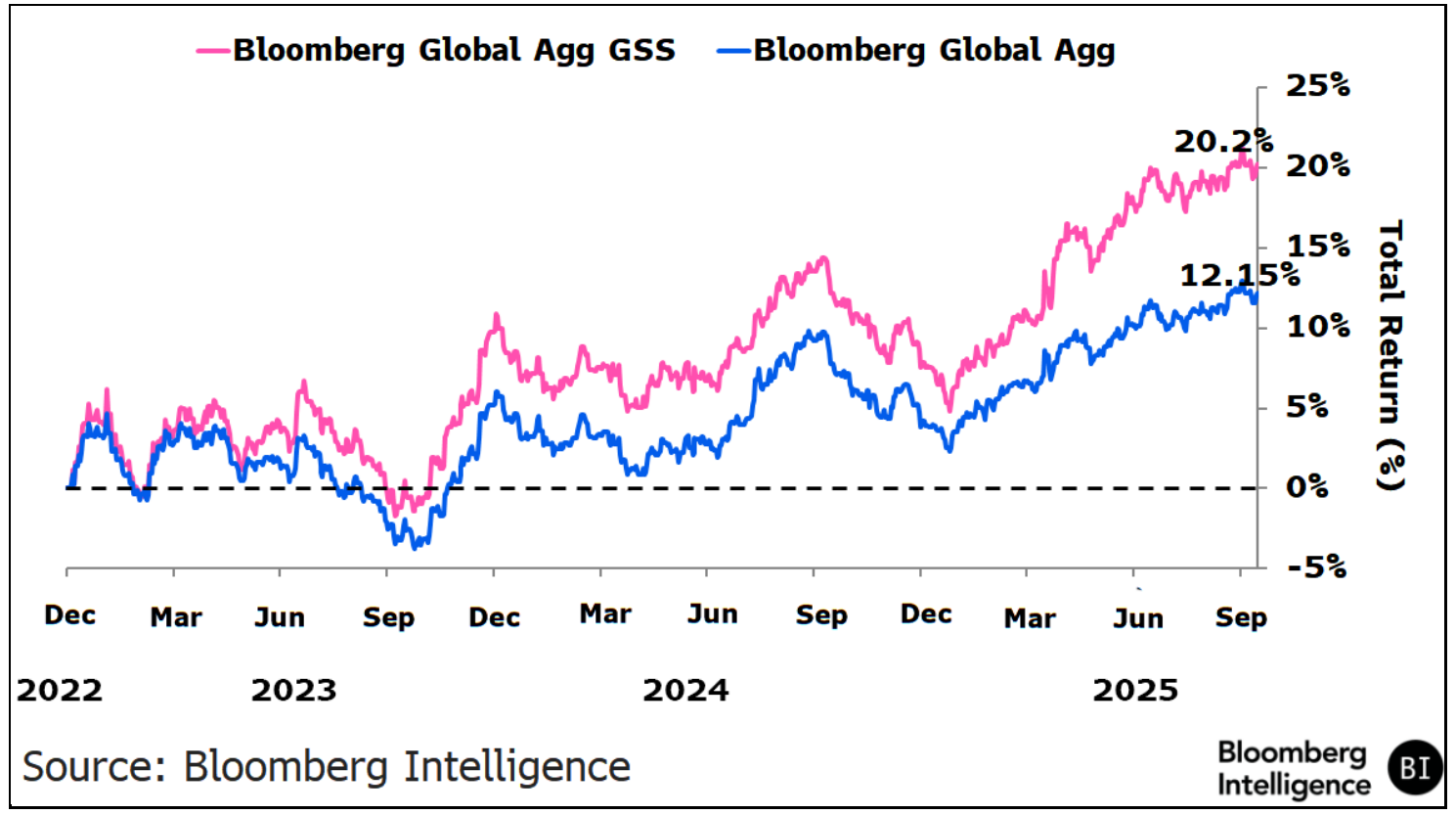

This trend is visible in fixed income markets: the Bloomberg Global Aggregate Green Social Sustainability Bond Index has outperformed the broader Bloomberg Global Aggregate Bond Index (see graphic below). Drivers for outperformance include strong investor demand, growing awareness of sustainability issues, and favorable financial conditions in 2025.

When sustainability risks are ignored, the consequences can be severe. Lack of proper analysis of ESG factors can lead to environmental disasters and governance failures that erode shareholder value and trigger sharp market corrections.

ESG controversies such as the Orpea scandal in 2022, where institutional mistreatment practices in retirement homes caused a drop of more than 90% in the share price 3, or the Teleperformance controversy related to the working conditions of content moderators, which led to a loss of 34% in a single session 4, illustrate the growing sensitivity of the markets to extra-financial risks. These cases highlight that investors are now reacting quickly to social and governance issues, and the need for active managers to consider ESG factors.

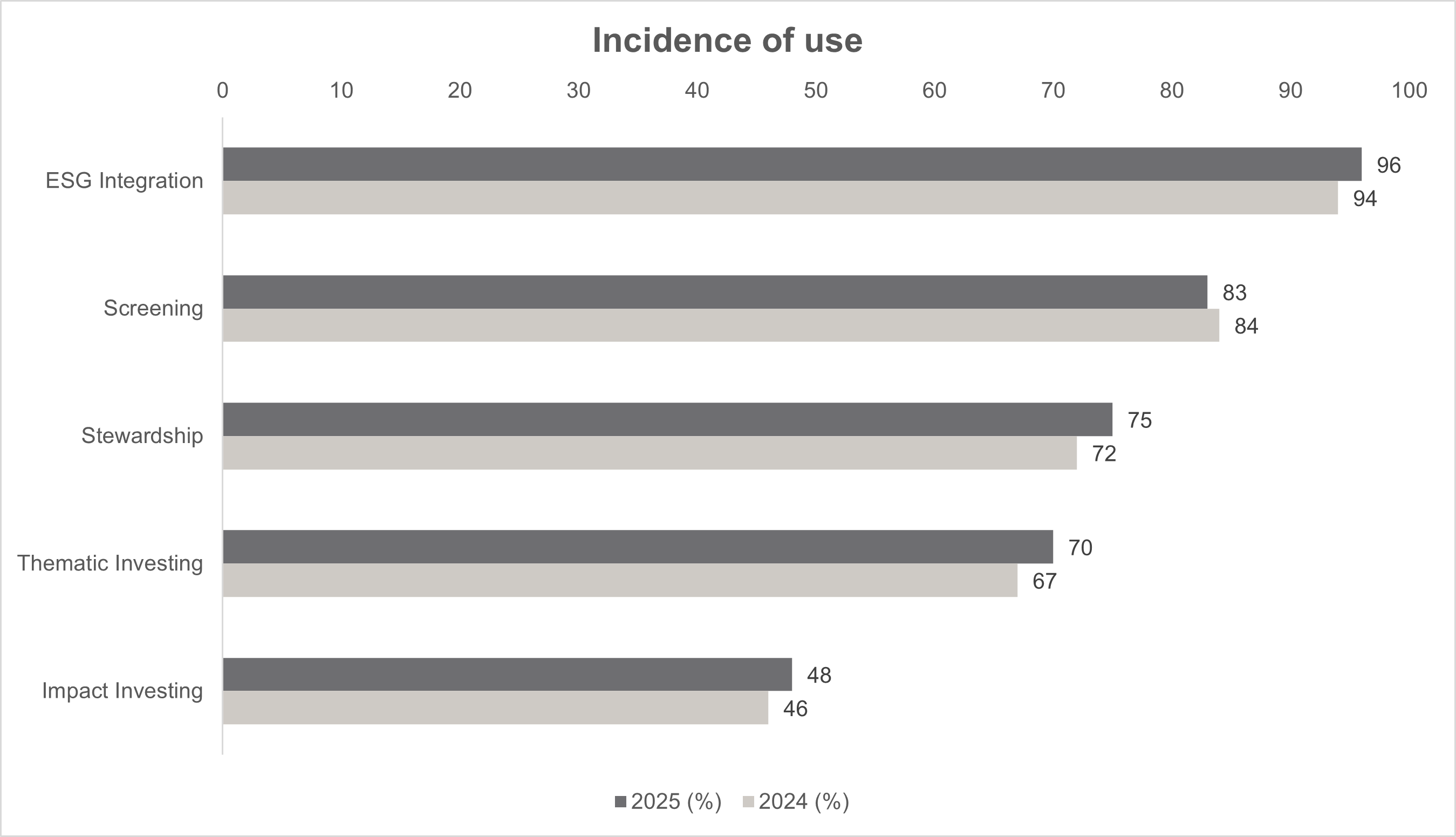

According to the latest Responsible Investment Association (RIA) trend report, ESG integration is now part of mainstream investment management in Canada 5,96% of respondents mentioned using it. Portfolio managers are recognizing the relevance of integration relevant ESG factors within their analysis to preserve capital and build more resilient portfolios.

Incidence of use per responsible investing approach

Source : 2025 Canadian responsible investing Trends

report - RIA.

Incidence of use: percentage of

respondents that apply each responsible investment approach within

their strategies.

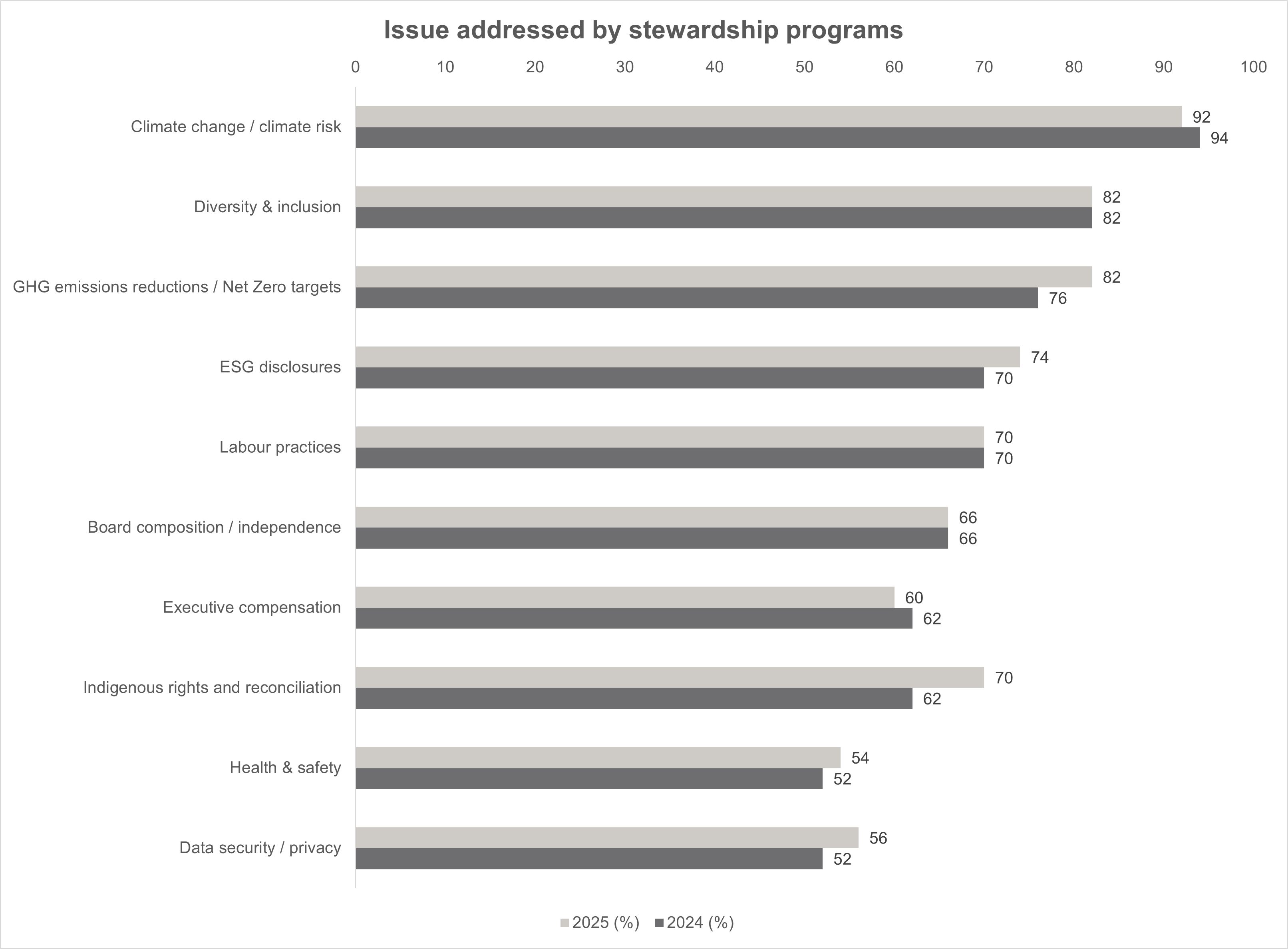

Stewardship for long-term value creation

Active managers don’t just pick stocks, they can also engage with companies through dialogues, shareholder proposals and proxy voting.

Through stewardship, active management can influence corporate behavior, improve governance, and align investments with a more sustainable economy. This means investments aren’t just chasing short-term gains they’re helping create long-term stability and value.

Stewardship is a key differentiator for active managers when they are building relationships with compagnies and following them long term in their journey to improve their practices. It signals to clients that their investments are not only managed for returns but also for long-term stability and risk mitigation.

The topics of conversation with compagnies can also be extremely broad depending on the enterprise and the sector of activities.

Unlocking opportunities in niche themes and impact areas

Passive strategies often replicate broad ESG indices, which can limit flexibility and expose investors to market-driven trends. Active management, on the other hand, can target specific themes such as renewable energy, water security, the circular economy that align with client goals, popular economic trends, and offer attractive returns potential.

It’s not just about choosing a theme. Active managers leverage deep sector expertise, analyzing both forward-looking and historical data to help investors avoid concentration risks and market bubbles that arise when everyone chases the same trend. This insight enables more effective diversification within a theme, reducing vulnerability to single-event shocks.

Summary

The perception of responsible investing has evolved. For active managers it is increasingly about managing risk and driving performance since ESG factors can have a real impact on returns. Considering ESG factors and ESG controversies as well as engaging with portfolio companies for long term value generation are all ways active managers are leveraging responsible investing to build more resilient portfolios.

Sources:

- What is financial materiality? - Greenly

- ESG 2.0 2026 Outlook - Bloomberg

- Orpea: can shareholders obtain compensation for the fall in the share price? - Capital

- Teleperformance: an emergency share buyback after a black Thursday - Les Echos

- 2025 Canadian RI Trends report - RIA