Meritage Portfolios®

Invest with confidence in a volatile economy

Explore all our Meritage Portfolios

Launched in 2006, Meritage Portfolios are an integrated actively managed investment solution designed to help investors achieve their financial goals. With 24 options tailored to a wide range of investor profiles, their success is built on partnerships with leading global portfolio management firms chosen for their expertise and proven performance.

- Meritage Tactical ETF Portfolios

- Meritage Strategic Portfolios

Why invest in Meritage Tactical ETF Porfolios

Markets are constantly evolving. To capitalize on opportunities or protect against certain risks, Meritage Tactical ETF Portfolios adopt tactical deviations from the initially targeted asset allocation.

Value added

An optimal blend of some of the best low-cost ETFs on the market and tactically managed asset allocation based on market conditions.

Tactical asset allocation

Meritage ETF Portfolios are regularly adjusted through a rigorous process. The allocation and selection of underlying ETFs evolve to reflect market trends, under the supervision of the Asset Allocation Committee, composed of economists and portfolio strategists from the National Bank group.

Currency management

NBI implements an active strategy to manage current exposure.

Construction of Meritage Tactical ETF Portfolios

Each quarter, the Asset Allocation Committee defines the tactical biases to be leveraged. Based on investment policies and the committee’s outlook, adjustments are made by increasing or reducing the weights of the underlying ETFs. These deviations typically have a horizon of a few months.

Risk monitoring and control

A monthly performance attribution ensures optimal risk management and compliance with portfolio objectives.

Why invest in Meritage Strategic Portfolios

A solution that combines the extensive expertise of renowned managers with a diversified asset allocation, designed to meet various investment objectives.

Value added

A selection of actively managed funds aimed at creating value, combined with a disciplined approach that maximizes potential while reducing risk.

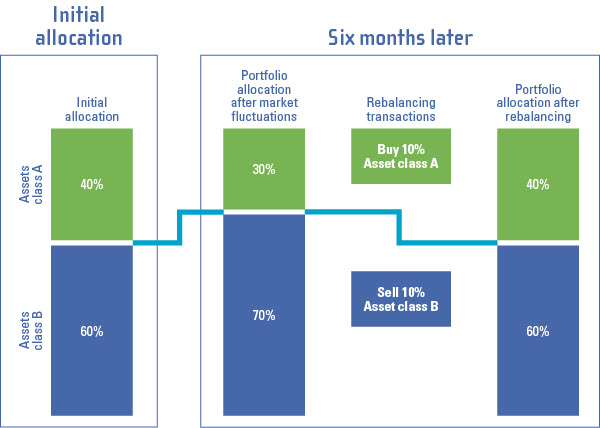

Automatic rebalancing

Meritage Strategic Portfolios are automatically rebalanced to maintain their target allocation and prevent overexposure to any specific asset class. If the market value of a fund deviates by more than 2.5% from its target allocation or an asset class varies by more than 5%, a rebalanding is carried out.

Currency management

Portfolio managers apply an active strategy to manage the currency exposure.

Construction of Meritage Strategic Portfolios

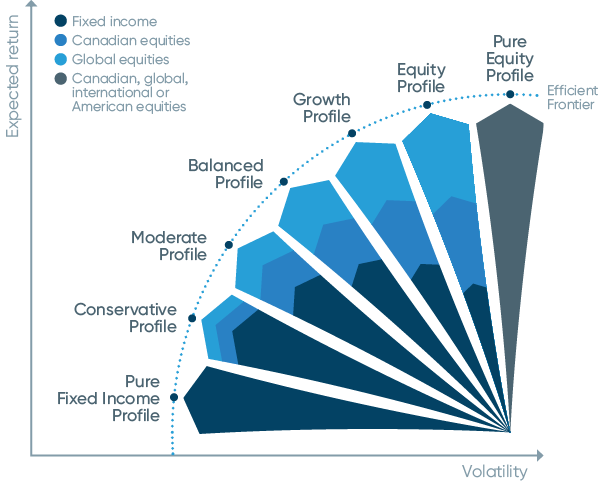

First, the portfolio’s objective and the optimization factors are established. Then, in consultation with economists and other experts, the potential returns, volatility and correlation of the main asset classes are estimated.

Once the investment objectives and quantitative parameters are set, NBI performs an optimization to maximize the risk/return ratio.

After determining the optimal asset allocation, the results are cross-checked against the return potential and risk parameters of the underlying funds selected for the portfolio’s construction.

A new optimization is performed each year to maintain an optimal allocation.

List of Meritage Strategic Portfolios

Conservative | Moderate | Balanced | Growth | Growth Plus

Conservative | Moderate | Balanced | Growth | Growth Plus

Canadian | Global | International | American

Agile

Our open architecture structure allows us to work with top-tier portfolio managers. The Meritage suite benefits from the combined expertise of 18 management firms, offering unique diversity and depth in the construction of these solutions.

Diligent

Through a three-stage selection process and in-depth analysis, we identify the best mutual funds and ETFs in the industry across management firms for each asset class to ensure optimal diversification.

Proactive

Our continuous ongoing monitoring of all the underlying funds that make up the Meritage Portfolios ensures that we are prepared for any eventuality, such as a change in portfolio manager change.

A range of portfolios

Meritage Portfolios offer solutions tailored to a range of investment profiles, from conservative strategies to growth oriented approaches. Regardless of your objectives, investment horizon and risk tolerance, there is a Meritage Portfolio that is suited for you.

Our portfolios offer optimal exposure and diversification by asset class, geographic region and sector, market capitalization and management style, all within an integrated range of managed portfolios.

People first

We believe that people are at the heart of finance and investing. Our wide range portfolio solutions is designed with your investment goals in mind.

Results driven

We carefully select and monitor portfolio managers to deliver a balance of growth and protection.

Access to top talent

Our flexible structure enables us to select top global portfolio managers.

Looking to diversify your investment approaches? Explore our full range of solutions designed to adapt to your goals and investment strategies.

NBI mutual funds

NBI mutual funds offer professionally managed, diversified investment solutions to help you reach your financial goals. Explore our mutual fund options to find the approach that works best for you.

NBI ETFs

NBI Exchange-Traded Funds provide low-cost, diversified exposure and innovative strategies, managed by professionals worldwide.

Sustainable solutions

Explore NBI sustainable solutions that combine responsible investing with long-term growth potential. Learn how you can make a positive impact while pursuing your financial goals.

Auto-rebalancing

Our approach

Meritage Equity, Investment, Income and Global Portfolios are automatically rebalanced when:

An example

Periodic rebalancing of a portfolio brings it back in line with its target asset allocation:

Tax-efficient distribution

How to benefit from a tax-efficient distribution?

Certain Meritage Portfolios are also offered as income portfolios to provide you with fixed monthly distributions1 made up, in part, of net income and

General information

General

- Meritage Portfolios: Advisor presentation

- Brochure

- Meritage Portfolios at a glance

- Meritage Portfolios summary table

Performance

- Monthly performance: Advisor Series | F Series

- Meritage Portfolios: Percentiles

- Meritage Portfolios: Morningstar 4- and 5-star ratings

Distributions

Quarterly Asset Evolution Reports

Outlook

Advisor material

General information

- Historical changes: Meritage Tactical ETF Portfolios | Meritage Strategic Portfolios

Investor Profile Questionnaire and Investment Policy Statement (IPS)

Investor Profile Questionnaire and Investment Policy Statement (IPS)

Meritage Portfolios provide a wide range of solutions, based on various criteria and suited for all types of investors. Regardless of your objectives, investment horizon and risk tolerance, there is a Meritage Portfolio that is right for you.

Investor Profile Questionnaire*

* FOR INFORMATION PURPOSES ONLY. This questionnaire is for information purposes only. It is not intended to replace a complete investment suitability analysis or to be considered as investment advice. It is intended solely as a reference document to assist investors in selecting the portfolio that best suits their investment needs. This questionnaire is not intended to replace any questionnaire required at the time of the purchase of securities, and at all times, the latter takes precedence.

Investment Policy Statement (IPS)

You are an advisor and have questions?

Our sales team

Benefit from our sales team’s expertise for personalized support. Available Monday to Friday from 8:30 a.m. to 5 p.m. (ET)

Operational support

Contact us:

Call us Monday to Friday from 8 a.m. to 8 p.m. (ET): 1-877-463-7627

Send us an email: dealer.services@nbc.ca

Little details that matter

1. The distribution is said to be fixed for each Meritage Income Portfolio as it does not vary from one distribution to the next. However, it is not guaranteed and may vary according to market conditions. Meritage Income Portfolios make monthly distributions at the end of each month. These monthly distributions are composed of net income and/or return of capital. For more information, please consult the simplified prospectus of Meritage Portfolios.

2. A return of capital reduces the value of the original investment and is not the same as the return on the investment. Returns of capital that are not reinvested may reduce the net asset value of the Portfolio and the Portfolio's subsequent ability to generate income.

The information and the data supplied on the current page of this site, including those supplied by third parties, are considered accurate at the time of their publication and were obtained from sources which we considered reliable. We reserve the right to modify them without advance notice. This information and data are supplied as informative content only. No representation or guarantee, explicit or implicit, is made as for the exactness, the quality and the complete character of this information and these data. The opinions expressed are not to be construed as solicitation or offer to buy or sell shares mentioned herein and should not be considered as recommendations.

Meritage Portfolios® (the “Portfolios”) are managed by National Bank Investments Inc., an indirect and wholly owned subsidiary of National Bank of Canada, and sold by authorized dealers. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Portfolios before investing.

NBI Funds (the “Funds”) are offered by National Bank Investments Inc., an indirect and wwholly owned subsidiary of National Bank of Canada, and sold by authorized dealers. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the Funds before investing.

NBI exchange-traded funds (the "NBI ETFs") are offered by National Bank Investments Inc., an indirect and wholly owned subsidiary of National Bank of Canada. Management fees, brokerage fees and expenses all may be associated with investments in NBI ETFs. Please read the prospectus or ETF Facts document(s) before investing. NBI ETFs are not guaranteed, their values change frequently and past performance may not be repeated. NBI ETFs units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns. NBI ETFs do not seek to return any predetermined amount at maturity.

The Portfolios’ securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Portfolios are not guaranteed, their values change frequently and past performance may not be repeated.

® MERITAGE PORTFOLIOS and the Meritage Portfolios logo are registered trademarks of National Bank of Canada, used under licence by National Bank Investments Inc.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under licence by National Bank Investments Inc.

National Bank Investments is a signatory of the United Nations-supported Principles for Responsible Investment, a member of Canada’s Responsible Investment Association, and a founding participant in the Climate Engagement Canada initiative.