Our fund series explained

Key information about our fund series offering

NBI Funds are offered across one or more series. The choice of series will have an impact on the fees paid and the compensation the advisor receives.

To see which funds are offered in our series, click into the fund codes on our product page.

Advisor, T & T5 Series

For more information on the T-Series, see the article 'A tax-efficient series'.

These series have an initial sales charge (negotiated with their dealer) that applies when investors purchase fund securities. Fees cannot exceed 5% of the purchase price of these securities.1

1 In the case of the NBI Jarislowsky Fraser Funds, initial sales charges are 0%.

How are they different?

The biggest differentiating factor lies in their distribution policies. The T and T5 series are meant more for investors looking to obtain regular, fixed monthly distributions. The Advisor series are more variable and difficult to predict, with any capital gains distributed annually in December.

F, F5 & FT Series

These series are only offered to investors with a fee-based account with dealers who have entered into an agreement with us.

Please note that this also applies to our FH Series (see the H & FH Series section below).

Fee structure

Investors pay their dealer an annual fee based on the asset value of their account instead of paying commissions or fees on each purchase, switch, conversion or redemption.

How are they different?

It all lies in their distribution policies. The F5 and FT series are meant more for investors looking to obtain regular, fixed monthly distributions. The F series are more variable and difficult to predict, with any capital gains distributed annually in December.

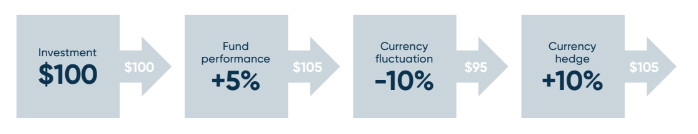

H & FH Series

Our hedged series are intended for investors looking to obtain exposure to foreign equity markets while minimizing the impact of foreign currency fluctuations against the Canadian dollar. When portfolio managers purchase foreign securities, foreign currency-forward contracts are used for hedging purposes, which aims to reduce fund turnover and transaction cost.

Fee structure

FH Securities

The dealer is paid an annual fee based on the asset value of the investor’s account instead of having the investor pay commissions or fees on each purchase, switch, conversion or redemption.

How are they different?

FH Series securities have the same attributes as F Series securities, and H Series securities have the same attributes as Advisor Series securities, except that they both aim to reflect the fund’s returns after all the exposure to currency fluctuations has been substantially hedged. Capital gains are distributed annually in December when applicable.

U.S.$-Advisor, U.S.$-F, U.S.$-FT & U.S.$-T Series

The U.S.$-Series has the same features and eligibility requirements as its corresponding Advisor, F, FT, and T Series. However, securities of the U.S.$-Series may only be purchased and redeemed in U.S. dollars.

How are they different?

These series differ only in currency.

ETF Series

ETF Series are an additional way to access our mutual fund strategies through an exchange-traded format and offer the same active management approach as other series within the same mutual fund family.

Fee structure

ETF Series share similar management fees as F series. However, units are bought and sold through a brokerage account, where standard trading commissions apply. There are no investment minimums.

How are they different?

Investors who don’t have access to F Series mutual funds can use ETF series to invest in actively managed strategies. They also simplify tax reporting since tax slips are issued by your dealer. Unlike mutual funds, systematic withdrawal plans and preauthorized contributions aren’t available.

Looking for more information on our Series? More details are available in our Prospectus.