Democratization and transformation

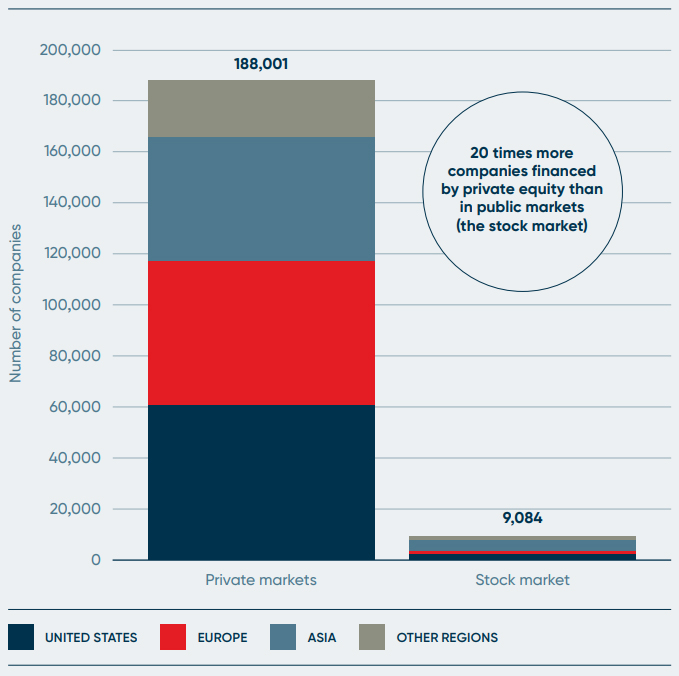

The appeal of private investments has been a growing segment for many investors wanting to have an exposure beyond public markets. Private equity, as an example, lies in its ability to access companies during their most transformative stages—often before they go public.

These investments have historically delivered strong returns, driven by active ownership and operational improvements. For investors seeking long-term growth, private investments can offer exposure to sectors and strategies that are often inaccessible through traditional public markets.

Private equity provides a larger set of opportunities

The private equity market is 20 X the size of public stock markets

Source : National Bank Investments, A primer on private markets

This democratization of private markets does not come without challenges. Understanding the different investment structures, performance metrics, and fees can be overwhelming. Yet, these hurdles are being overcome through vehicles such as evergreen funds and funds of funds (or pooled funds), which provide diversified exposure and periodic liquidity, making the asset class more approachable to qualified investors. At the same time, those who are not ready to fully commit to private markets but still want some exposure can invest in ETFs that offer access to a basket of publicly listed private equity firms active in the private market space.

Private market access amid yield and volatility challenges

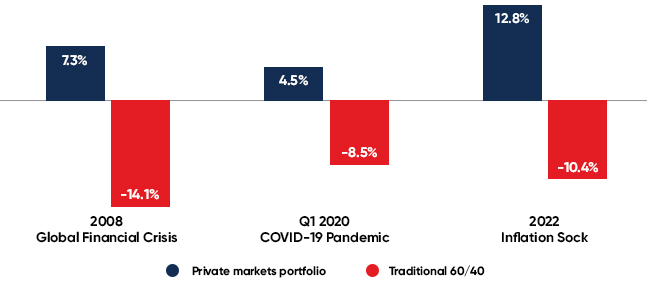

The timing of this shift is significant. Canadian investors are navigating an environment where traditional fixed income struggles to deliver meaningful yields and public equity markets face heightened volatility. History shows that private markets have often remained resilient during periods of turbulence, frequently outperforming a traditional 60/40 portfolio in real life market events such as the Global Financial Crisis or during the Covid-19 pandemic shock.

This simulated performance information is provided for illustrative purposes only and is subject to a number of limitations

Source: Preqin and MSCI, as at December 31, 2024. Traditional 60/40 is comprised of MSCI World Index GR CAD (20%), S&P/TSX. Composite Index TR CAD (20%), S&P 500 TR CAD (20%), ICE Bofa Canada Broad Market TR CAD (40%). The private markets portfolio is comprised of Preqin Global Private Equity Index CAD (1/3), Preqin Global Private Credit Index CAD (1/3), Preqin Global Private Infrastructure Index CAD (1/3). Portfolios are rebalanced on a quarterly basis. Data denominated in CAD. Private equity returns are shown net of fees, expenses and carried interest.

Private investments offer an alternative path for investors, well aligned with long-term goals such as retirement planning and wealth accumulation. Many strategies also tap into megatrends like technology innovation, sustainability, and demographic shifts, drivers expected to fuel economic growth for decades.

Private investments today and for future growth

For Canadian investors, the opportunity is clear: private investments are no longer a distant aspiration but an attainable component of a well-constructed portfolio. As access broadens, they are poised to become a cornerstone of modern wealth strategies in Canada, delivering not only dynamic diversification, but also a chance to participate in the engines of future growth.