An overlooked opportunity set

Emerging markets (EM) remain among the most diverse and dynamic segments of global investing. Yet the breadth of opportunities is often underrepresented in benchmarks and, by extension, in investor portfolios. A key challenge lies in concentration. China, India, Taiwan, and South Korea together make up three quarters of the MSCI Emerging Markets Index, with China and India accounting for nearly half its total weight. At the other end of the spectrum, nearly 70% of index constituents hold minimal weights below 0.05%, limiting their influence on overall performance*. As a result, the standard benchmark offers a distorted and partial representation of the true opportunity set, leaving much of the asset class’s potential overlooked.

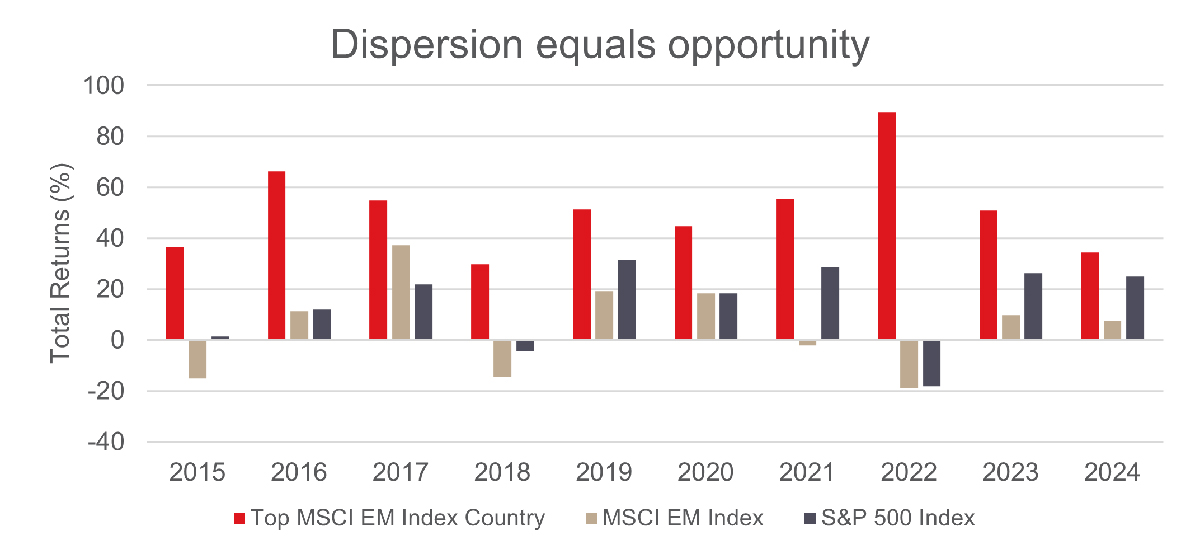

Despite their small index weights, countries such as Mexico, Greece, and Egypt have delivered strong growth and competitive returns in recent years*. Diversifying across countries and company sizes can help investors achieve a more balanced representation of the EM opportunity while also mitigating concentration risks. Beyond the benchmark, a vast universe of innovative businesses, regional champions, and structural growth stories remains unexplored by index-focused strategies.

Source : Artisan Partners/FactSet/MSCI/S&P. Data as of December 31, 2024. “Top MSCI EM Index Country” refers to the country with the highest total return in the MSCI Emerging Markets Index in each period. Past performance does not guarantee and is not a reliable indicator of future results.

For active investors like the Artisan Partners Sustainable Emerging Markets Team, this breadth offers a fertile landscape for uncovering companies capable of compounding value across cycles. Many of these businesses receive little attention from traditional analysts, yet demonstrate earnings resilience, responsible capital allocation, and stakeholder alignment, characteristics that can underpin durable, long-term growth.

Valuation discount and global growth drivers

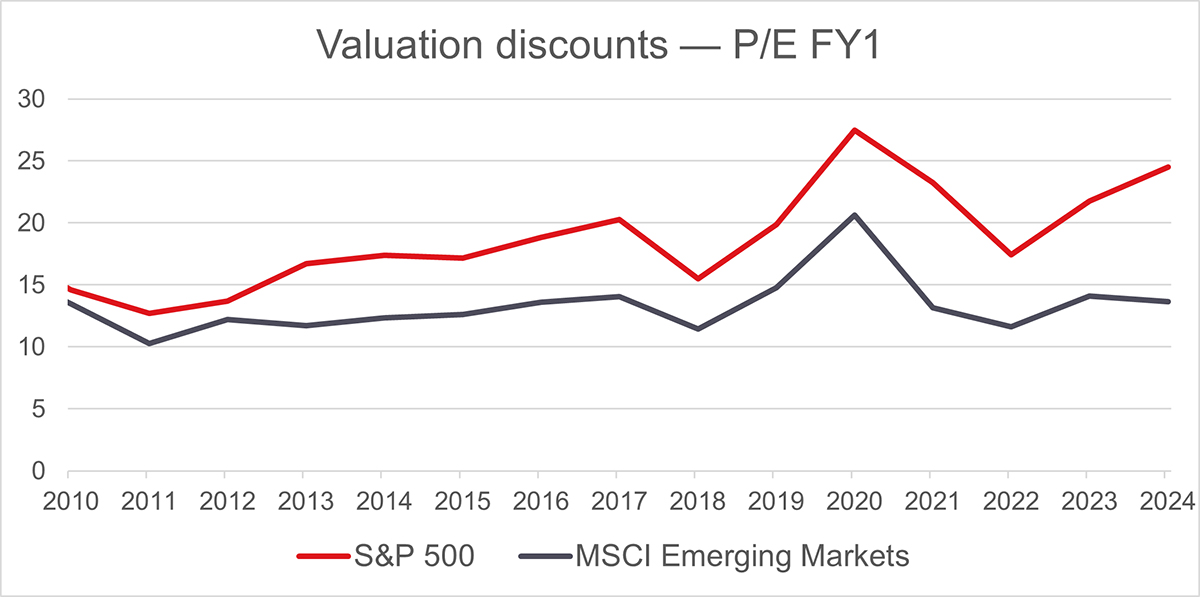

EM equities today trade at meaningful discounts relative to both developed markets and their own history. On a price-to-book basis, the MSCI Emerging Markets Index trades at nearly a 40% discount to developed markets, compared to a 20-year average discount of 17%*. Forward earnings multiples tell a similar story, with EM equities valued at roughly half the level of the S&P 500® Index.

Periods of such disparity have historically coincided with subsequent EM outperformance. In the early 2000s, when discounts were similarly wide, EM went on to outperform developed markets for nearly a decade*. Current pricing appears more reflective of investor caution and perception-driven discounts than of structural weakness, suggesting attractive entry points for long-term investors.

Source : Artisan Partners/FactSet/MSCI/S&P. Data as of December 31, 2024.

However, discounted valuations alone do not define the EM case. These economies are increasingly central to global growth, representing roughly 85% of the world’s population and nearly 70% of incremental GDP growth over the past decade*. Expanding middle-class populations are compounding demand across industries such as financials, health care, and e-commerce.

EM is increasingly defining the frontier of global innovation and technology. Taiwan and South Korea anchor semiconductor supply chains, while China now accounts for nearly 30% of global R&D spending*. Brazil has emerged as a leader in fintech adoption, and many EM countries are leapfrogging traditional development paths to assume leadership roles in innovation. Their contributions to the clean energy transition, from rare earths and resource transformation to renewable power generation and adoption, underscore their growing influence in shaping the future of global progress.

At the same time, EM is demonstrating remarkable resilience and demographic strength. Greece and Argentina, once written off, are staging historic comebacks, offering compelling examples of resiliency. Countries like Poland, Slovenia, and Kazakhstan are attracting increased capital inflows, driven in part by rising uncertainty in developed markets. Across Africa, India, and Southeast Asia, a demographic dividend is poised to fuel sustained economic expansion and entrepreneurial dynamism, positioning these regions as engines of long-term growth.

Discovering hidden gems beyond the benchmark

Investors who look beyond index composition and headline narratives, focusing instead on long-term secular themes and resilient business models across geographies, are better positioned to capture the growth potential that EM can deliver. Each EM country, sector, and company offers a distinctive combination of opportunities and risks.

In this sense, EM investing is not about chasing volatility or broad macro calls. It is about identifying companies with sustainable competitive advantages and enduring earnings power. For those willing to look deeper, EM present fertile ground for seizing compound return opportunities.

Learn more about the NBI Diversified Emerging Markets Equity Fund sub-advised by Goldman Sachs Asset Management and Artisan Partners.

Conclusion

International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging and less developed markets.