1. The big data advantage

Data explosion

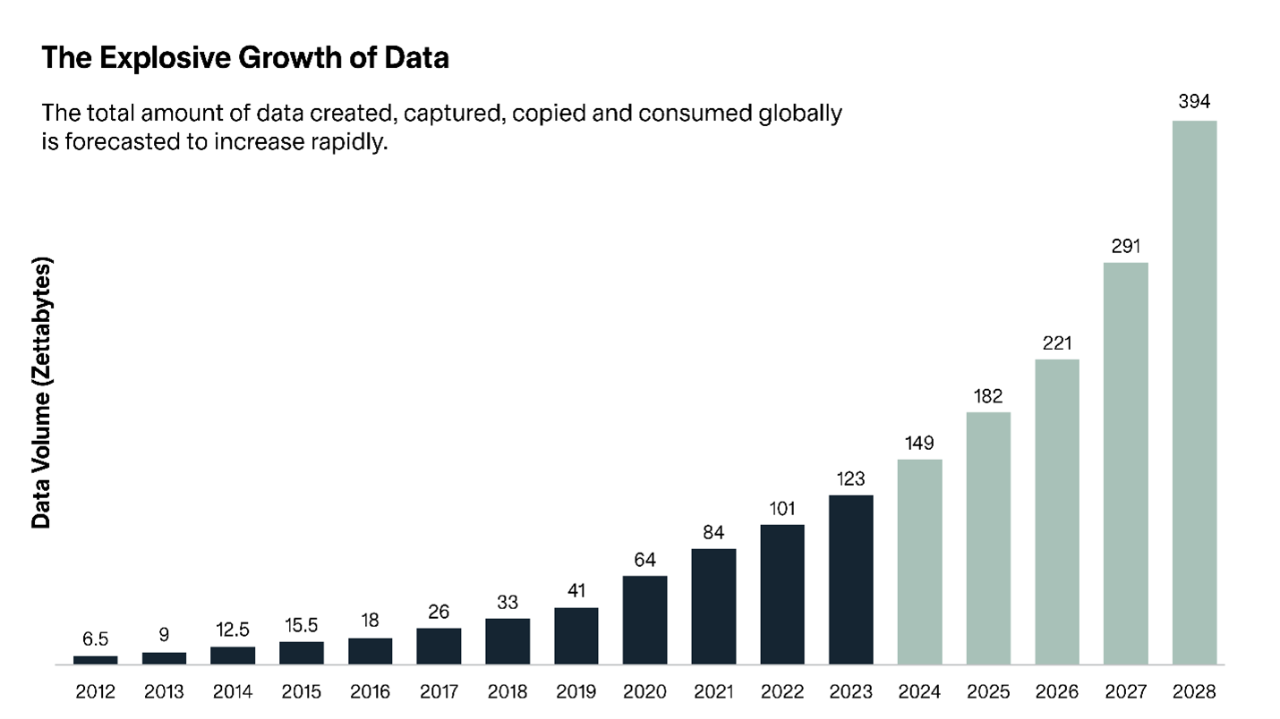

The world’s data volume has grown more than 10x in the last decade and is projected to keep accelerating. This surge includes structured financial data and vast unstructured datasets—text, audio, images, and alternative data sources. For investors, this means more signals to identify alpha opportunities as well as greater complexity requiring advanced analytics.

Speed and scale

Quantitative managers leverage cutting-edge technology and computational power to process massive datasets in real time. This capability essentially enables faster decision-making and provides an informational edge over traditional managers ultimately, enhancing the ability to uncover subtle patterns and correlations.

Source : GSAM, “Harnessing the Power of Artificial Intelligence (AI) in Equity Investing”. For Illustrative purposes only.

2. Adaptability in dynamic markets and the rise of AI

Markets are constantly evolving, influenced by structural shifts (e.g., rise of index investing, shorter holding periods) and brief shocks (e.g., pandemics, tariffs). Quant strategies excel in this environment because they:

- continuously refine models to reflect new realities;

- rapidly integrate new data sources;

- exploit inefficiencies and price dislocations that traditional approaches might overlook.

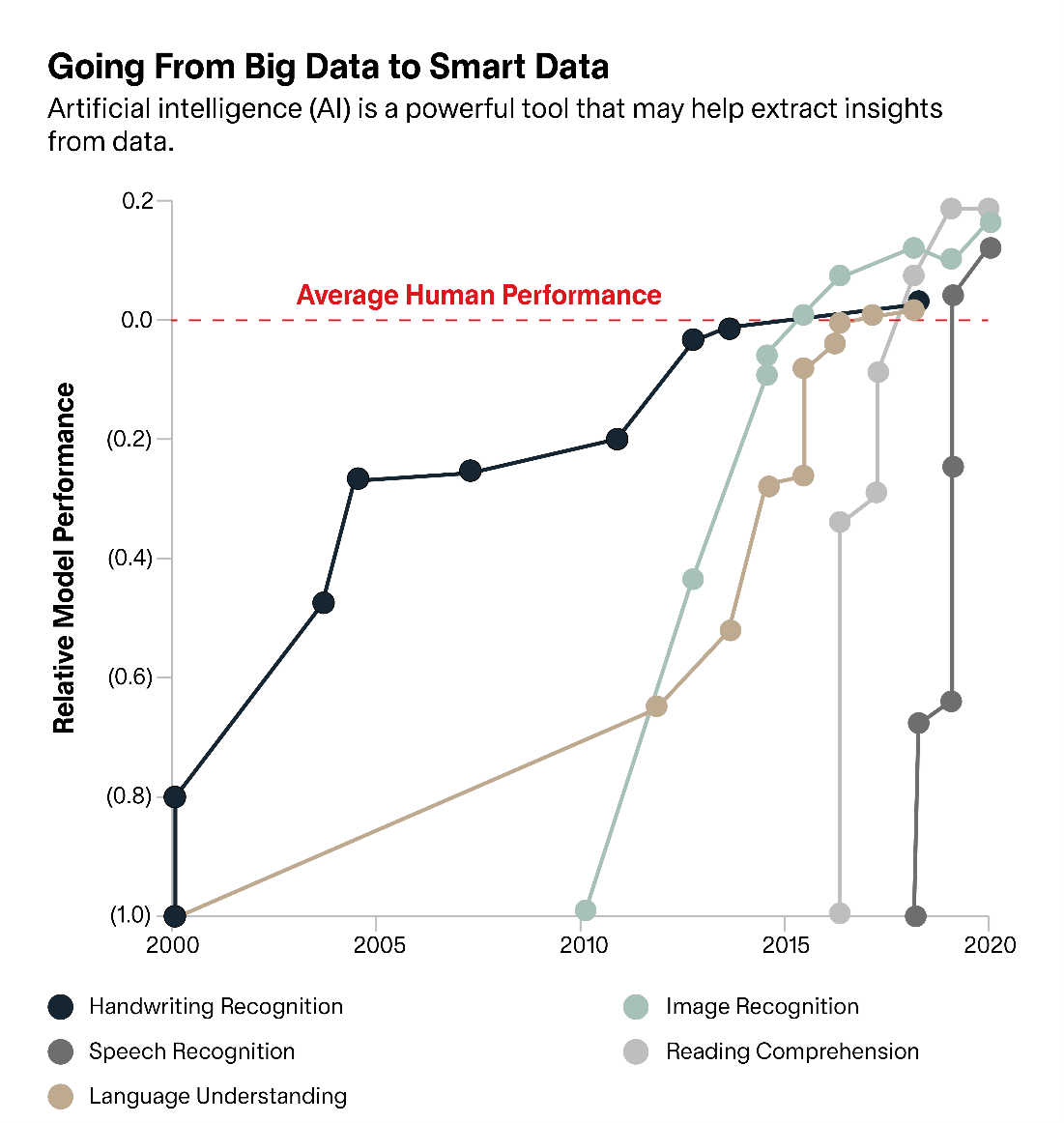

Source : GSAM, “Harnessing the Power of Artificial Intelligence (AI) in Equity Investing”. For Illustrative purposes only.

Also, advancements in artificial intelligence, particularly large language models, represent both new developments and extensions of decades-old techniques, coinciding with an exponential increase in large, complex, and unstructured datasets. This growth enhances the value of quantitative methods for detecting patterns and anomalies that traditional investment strategies might overlook.

3. Objectivity and transparency

Quantitative investing is rooted in a systematic, data-driven process. Unlike discretionary strategies that rely heavily on human judgment, quant models apply explicit, rules-based frameworks. This approach:

- reduces human biases;

- provides clear explanations for investment decisions;

- ensures consistency even amid personnel changes.

Transparency in methodology also enables agility, allowing managers to adapt quickly to shifting market conditions without compromising the integrity of the strategy.

Why it’s a competitive edge and looking ahead

In current markets, data alone is not sufficient. Combining high-quality data with advanced AI and machine learning techniques, as well as human economic analysis, supports the interpretation and validation of insights. This approach enables quantitative managers to deliver risk-adjusted returns, achieve diversification across asset classes, and maintain resilience through varying market cycles.

As AI and data continue to reshape the investment landscape, quantitative strategies will remain at the forefront. Firms with scale, robust infrastructure, and a culture of research and innovation—like that of Goldman Sachs’ Quantitative Investment Strategies team, who manage the NBI SmartData Funds and ETF series, are best positioned to harness these trends and deliver differentiated outcomes.