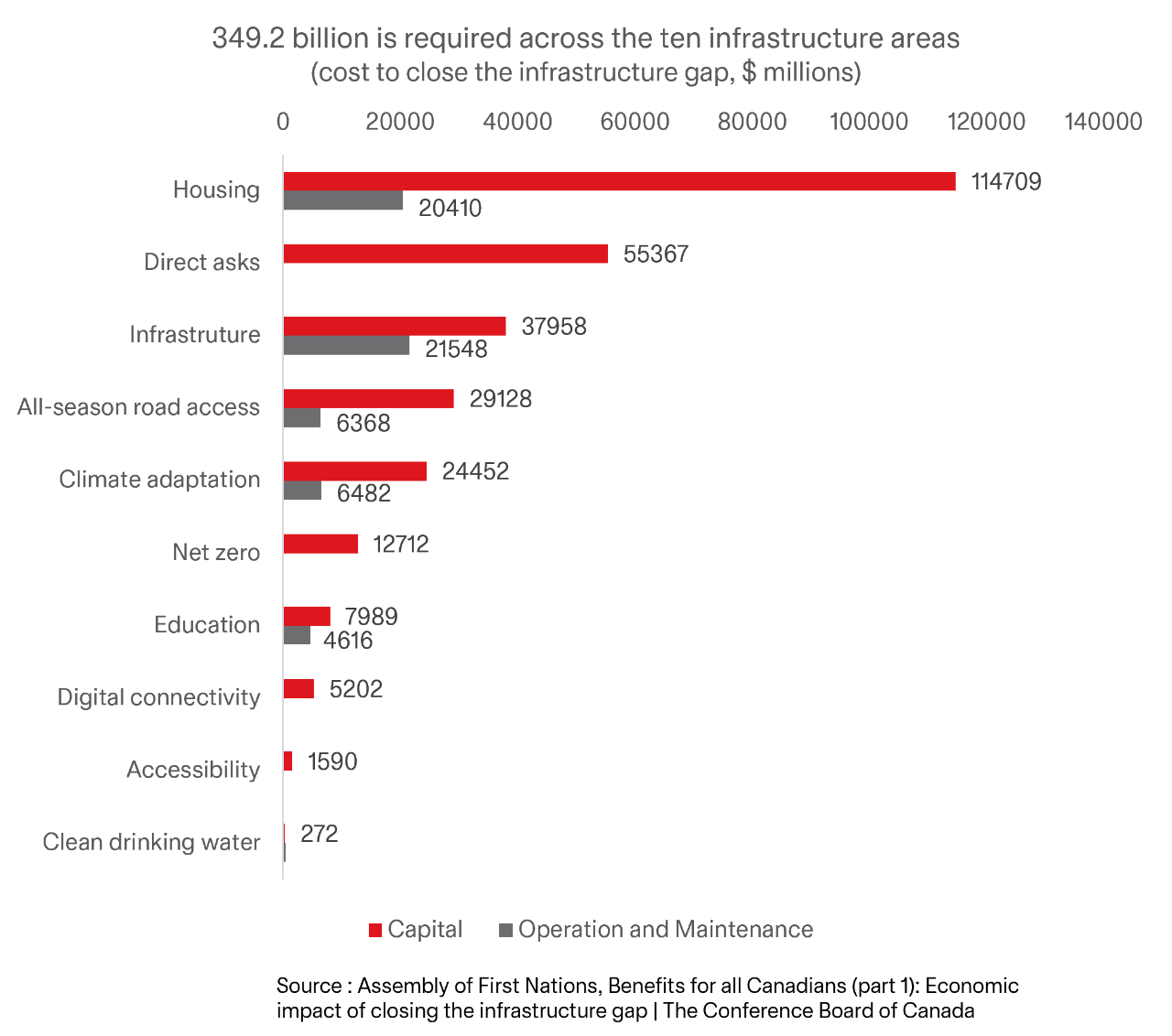

A $349.2B infrastructure gap in Indigenous communities

Indigenous communities in Canada have long faced chronic underinvestment, resulting in significant infrastructure gaps compared to the rest of the country. According to the Assembly of First Nations, an estimated $349.2B is needed over seven years to close this gap across more than 600 First Nations 1.

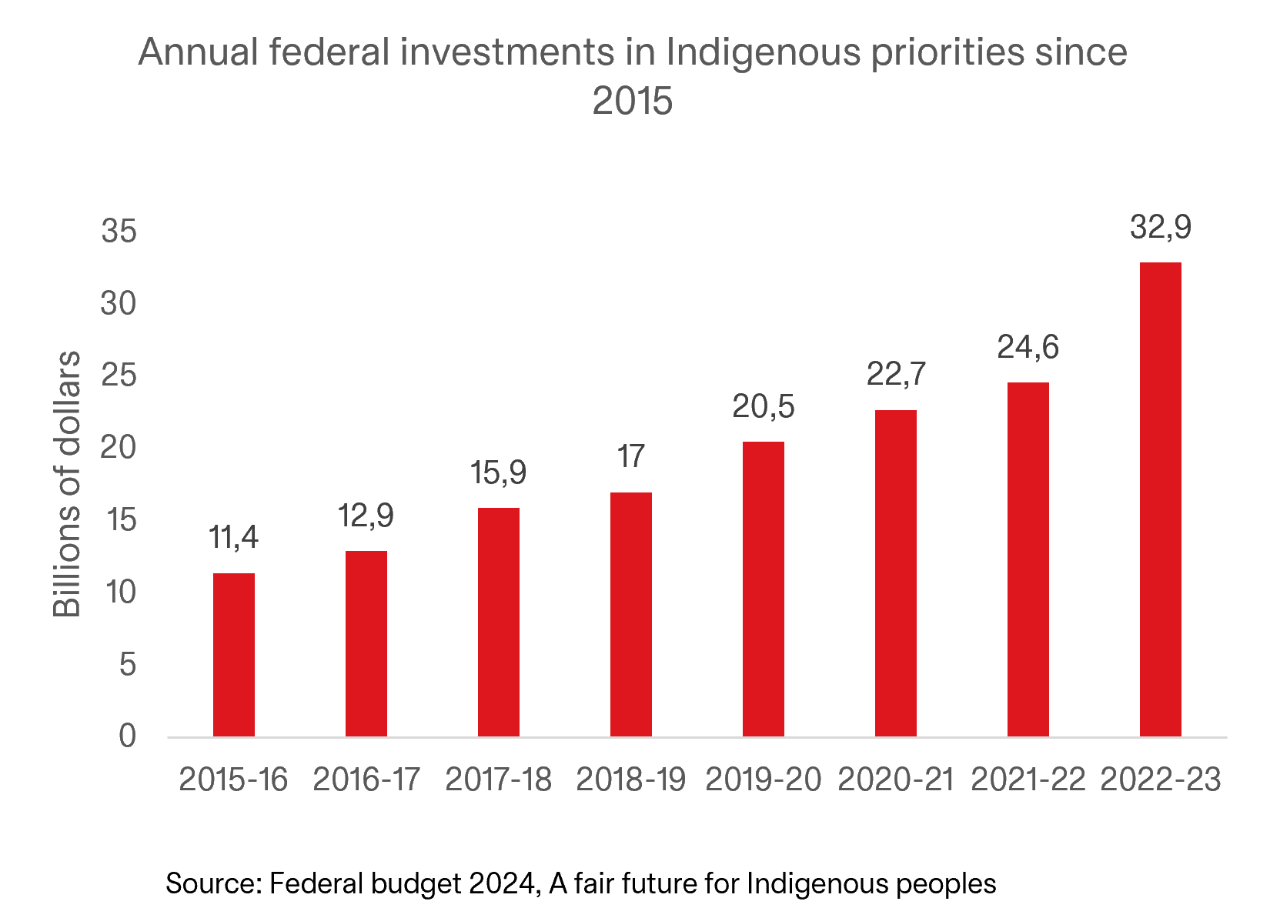

Since 2015, the federal government has implemented targeted budget measures to address these disparities. In partnership with First Nations, Inuit, and Métis communities, it is deploying distinction-based investments that respond to priorities identified by Indigenous Peoples themselves, laying the foundation for inclusive and sustainable growth.

Graph: Investments in Indigenous Priorities Since 2015

The United Nations Declaration on the Rights of Indigenous Peoples, Bill C-5 and the associated investment opportunities

Canada’s policy landscape is evolving to strengthen Indigenous rights and accelerate infrastructure development.

The United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) 2023–2028 Action Plan: In 2023, the federal government launched a historic action plan to align Canadian laws with the principles of UNDRIP. Developed in partnership with Indigenous communities, the plan outlines concrete measures to implement the rights and principles set out in the Declaration and to advance reconciliation in meaningful and measurable ways.

The plan includes regulatory, policy and program reforms to integrate Indigenous rights, including Free, Prior and Informed Consent (FPIC) into Canada's legal and institutional frameworks.

Bill C-5 (One Canadian Economy Act) : Passed in June 2025, Bill C-5 aims to accelerate infrastructure projects deemed to be of national interest by simplifying regulatory processes and reducing approval timelines. While the full list of fast-tracked projects has yet to be released, categories mentioned include ports, trade corridors, energy and mining projects, and transportation infrastructure.

Many of these projects are located on or near Indigenous lands, raising important governance and land rights considerations.

Why it matters for investors

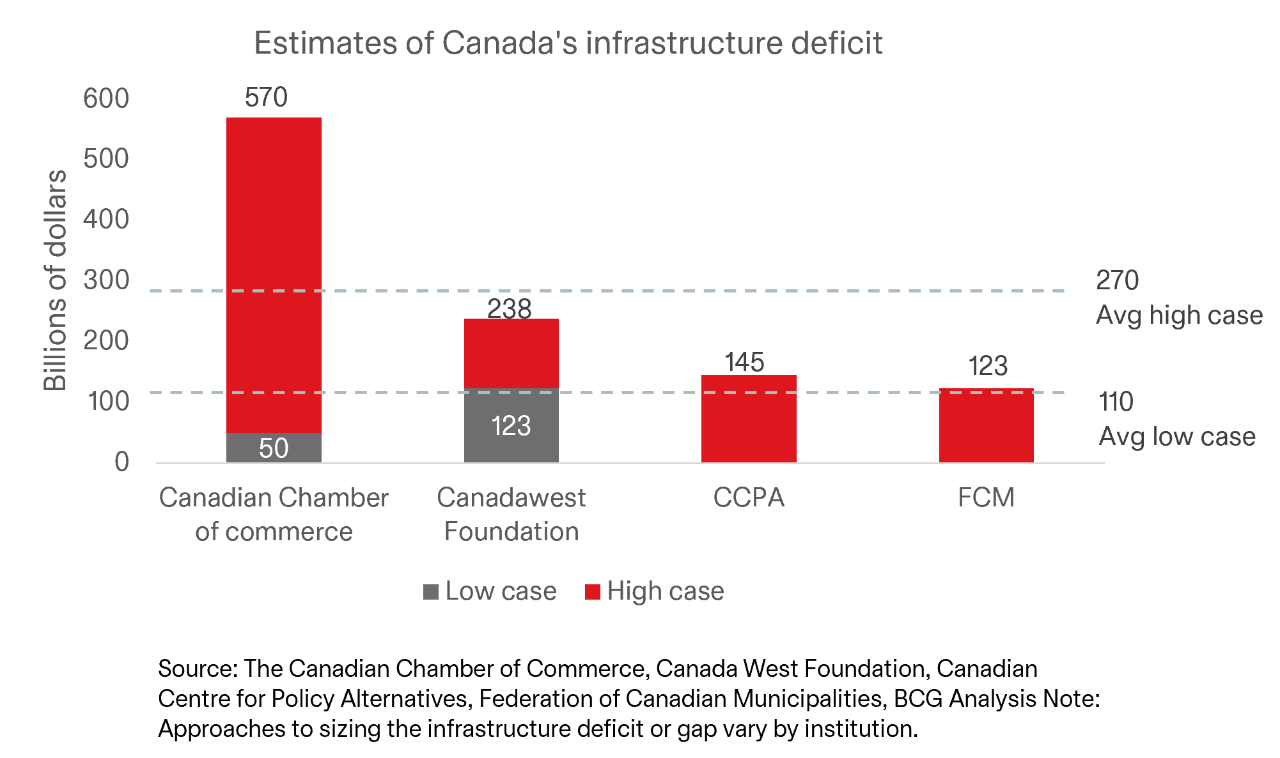

The infrastructure deficit in Canada is estimated to be as high as $270B3, just to maintain existing assets. Indigenous communities can play a role in Canada’s major infrastructure projects as many proposed projects are located on Indigenous lands. In today’s uncertain global economy, projects that meaningfully engage Indigenous communities are more likely to succeed. Those that do not face heightened legal, reputational, and operational risks.

Beyond risk management, reconciliation offers forward-looking investment opportunities. Indigenous communities can be key partners in innovative projects related to clean energy, housing, digital infrastructure, and sustainable land use 4. These initiatives align with global macroeconomic trends such as climate transition, inclusive finance, and sustainable development, allowing investors to support equity and resilience while contributing to Canada’s long-term economic growth.

Case Study: Ontario Power Generation and the Nanticoke Solar Project

Ontario Power Generation (OPG) partnered with two Indigenous communities, the Six Nations of the Grand River Development Corporation, and the Mississaugas of the Credit First Nation to develop Nanticoke Solar, its first solar farm. The project was built on the site of the province’s largest former coal-fired power station—transforming a symbol of fossil energy into a beacon of clean power and reconciliation.

Impact Highlights:

- Financial: A $1M investment in these bonds avoids 270 tons of CO₂eq.

- Environmental: The project avoids 28,681 tons of CO₂ equivalent emissions annually.

- Social: The initiative strengthens ties with Indigenous communities and revitalizes a decommissioned site through inclusive development.

This bond is held within the NBI Sustainable Canadian Bond Fund as of June 30, 2025.

Reconciliation in motion, emerging opportunities for long-term investors

There is a growing pool of investment opportunities in sectors such as clean energy, infrastructure, housing, and sustainable resource management, that requires the participation of First Nations to support Canada’s long-term economic development. These initiatives are not only advancing economic reconciliation, but they are also reshaping the investment landscape.

Government commitments, including distinctions-based funding and inclusive procurement policies, are accelerating this shift. Investment advisors who understand this evolving context will be well-positioned to guide clients toward investments that are both financially sound and impactful, contributing to a more inclusive and resilient Canadian economy.

Learn more about responsible investment at NBI

Discover our sustainable Solutions