Highlights

After a brief period of consolidation, equities continued their steady ascent in July, extending their lead over bonds.

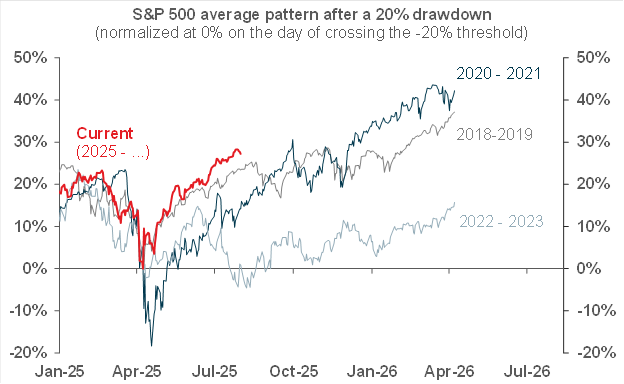

With hindsight, equity markets have essentially been writing variations of the same story for seven years now. First, a certain shock sends markets tumbling in a big way. This decline is followed by a strong rebound often perceived as excessive, but which ultimately proves to be durable once a pivot by policymakers is initiated.

For the time being, the U.S. economy is holding up well, with the outlook for corporate profits appearing to stabilize, if not improve, while the labour market remains in equilibrium.

However, the most overlooked positive news of recent months probably concerns the impact of U.S. tariffs on consumer prices. Indeed, the CITI Inflation Surprise Index is at its lowest level in almost 10 years, indicating that forecasters were expecting U.S. inflation to be much more vigorous than is currently the case.

In this context, a window could indeed open for the Federal Reserve to gradually bring its policy rate closer to neutral over the coming quarters.

All in all, while a moderate equity pullback is quite conceivable over the next few months, there is every reason to believe that the general uptrend should continue, although elevated valuations mean that we can expect a more modest pace of growth for the remainder of the year.

Bottom Line

Beyond the political noise, the current environment carries significant tailwinds for the economy which could be amplified by a pre-emptive shift in tone toward a more dovish stance at the Federal Reserve. This context explains why we have gradually adjusted our strategy in favour of risky assets since May, a positioning we still consider appropriate.