Highlights

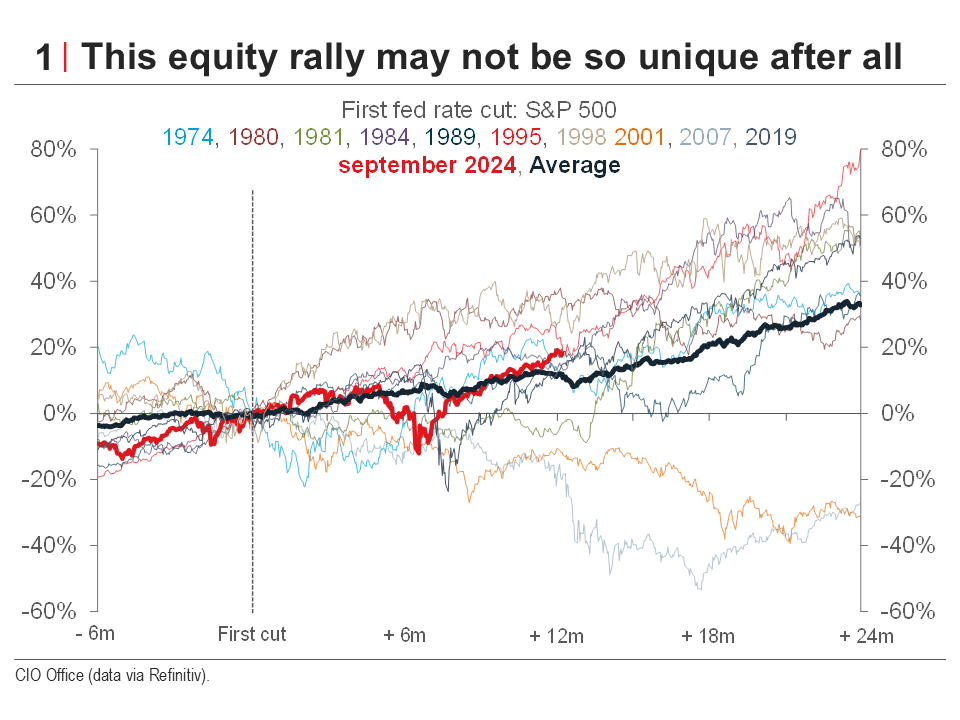

The third quarter ended on a high note, with financial markets enthusiastically welcoming the Fed's decision to cut interest rates for the first time since last December. But, does this mean that the proverbial “soft landing” has been achieved?

While this seems to be the case in Europe, in Canada, the slowdown in inflation has been accompanied by much greater turbulence in the job market. As for the United States, the situation is more difficult to define.

At first glance, several aspects of the U.S. economy appear to be on the right track with monetary policy perhaps already neutral, a job market that has not passed the point of no return, and encouraging signs for the manufacturing sector.

However, a return to target for inflation remains unlikely, with service inflation no longer slowing just as goods and food prices begin to rise again, likely driven in part by tariffs.

In short, although volatility is likely to return at some point in Q4, we continue to believe that the uptrend will remain dominant, driven by continued economic expansion against a backdrop of more accommodative monetary and fiscal policies. Within equities, we have marginally adjusted our positioning in favour of emerging markets, where a series of promising signals have accumulated over recent months.

Bottom Line

Overall, while a complete landing of U.S. inflation will have to wait, the outlook for growth remains positive. This environment continues to justify a pro-risk asset allocation strategy, while preserving room to maneuver should better buying conditions arise.