Highlights

With Summer drawing to a close, there's no denying that the hot season has been rather clement for equity markets, with equities posting gains for the fourth consecutive month in August.

However, we should not be under any illusions. Periods of low volatility can never last forever, and September is historically the month with the lowest average returns.

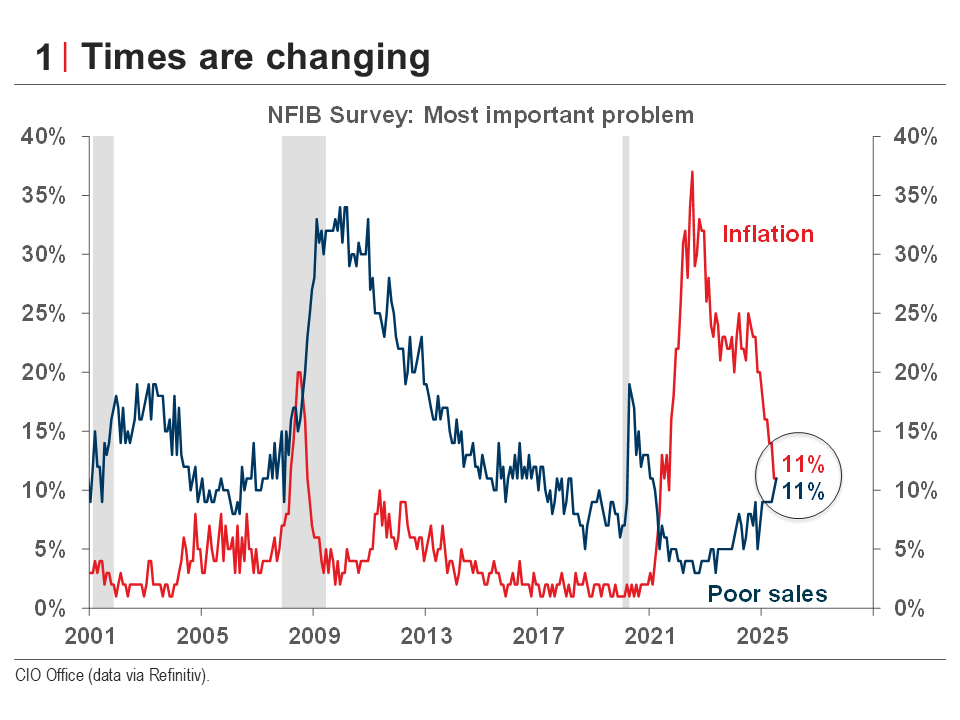

While inflation remains something to watch, it must be acknowledged that, for now, it is not as dramatic as some feared six months ago when the new tariffs were first introduced. In fact, for the first time since May 2021, small businesses in the U.S. are no longer more concerned about inflation than they are about weak sales.

In these changing circumstances, keeping interest rates at restrictive levels was becoming increasingly difficult to justify for the Fed, which should effectively begin a gradual transition to a neutral monetary policy shortly.

Unfortunately, this change in direction is taking place in a context of extreme political pressure, and a controversial appointment to succeed Powell, due to be announced this Fall, would likely cross the line. To be continued but, for now, it is not clear that the Fed's actions are guided by anything other than its mandate, regardless of what the U.S. president thinks

Bottom Line

Bottom line: While the list of potential reasons is long for a stock market pullback in the short term, the upward trend should remain dominant supported by earnings growth and more accommodative policy stances. By comparison, bond markets already seem to be pricing in a number of rate cuts over the next year, leaving little room for sizeable gains.