Opportunities in listed infrastructure

Recent economic trends and market dynamics have highlighted the potential advantages of investing in publicly listed infrastructure companies as part of a well-diversified portfolio. These companies own or operate assets that are integral to economic activity and everyday living as they facilitate the movement of people, energy, goods, commodities, and information. Unlike sectors that are more closely tied to the ups and downs of the economic cycle, demand for the essential functions and services that infrastructure companies provide is inelastic and tends to remain steady regardless of changes in economic conditions.

Additionally, listed infrastructure has historically been an effective hedge against inflation as replacement costs for infrastructure assets increase in inflationary environments, and as cash flows generated from these assets are commonly linked to inflation. Its more defensive characteristics and inflation hedging potential together make a strong case for infrastructure as an asset class. Moreover, we are also witnessing today a secular growth story for infrastructure that hasn’t existed in decades, potentially making investments in listed infrastructure even more compelling than ever before.

The infrastructure evolution: investing in energy megatrends

Publicly listed infrastructure is uniquely positioned to provide investors with exposure to some of the most powerful fundamental themes currently driving global markets. In our view, the booming investment cycle around generative artificial intelligence (AI) will drive a proliferation of data centre development. When coupled with growth in the onshoring and nearshoring of manufacturing capacity, the U.S. will experience a period of accelerating demand for electricity not seen in a generation.

Meeting this collective demand will necessitate expanded electricity-producing resources across generation types, particularly in renewable energy technologies, nuclear, and natural gas. Across its broad range of industry sectors, shown in Figure 1 below, listed infrastructure appears poised to grow as a clear beneficiary of the energy demand mega theme. And while this will create opportunities across the investable infrastructure universe, there will inevitably be relative winners and losers among specific industries and individual companies over time.

Listed infrastructure sectors

The power-hungry global economy

Several dynamics in the evolution of the global economy point to a future in which rapidly increasing energy production will be paramount. Current investment in AI stands just shy of $235 billion globally, while according to IDC¹, forecasts show that number reaching $631 billion by 2028. Keeping up with this rapid growth will require significant development of new data centre infrastructure with profound implications for additional power generation.

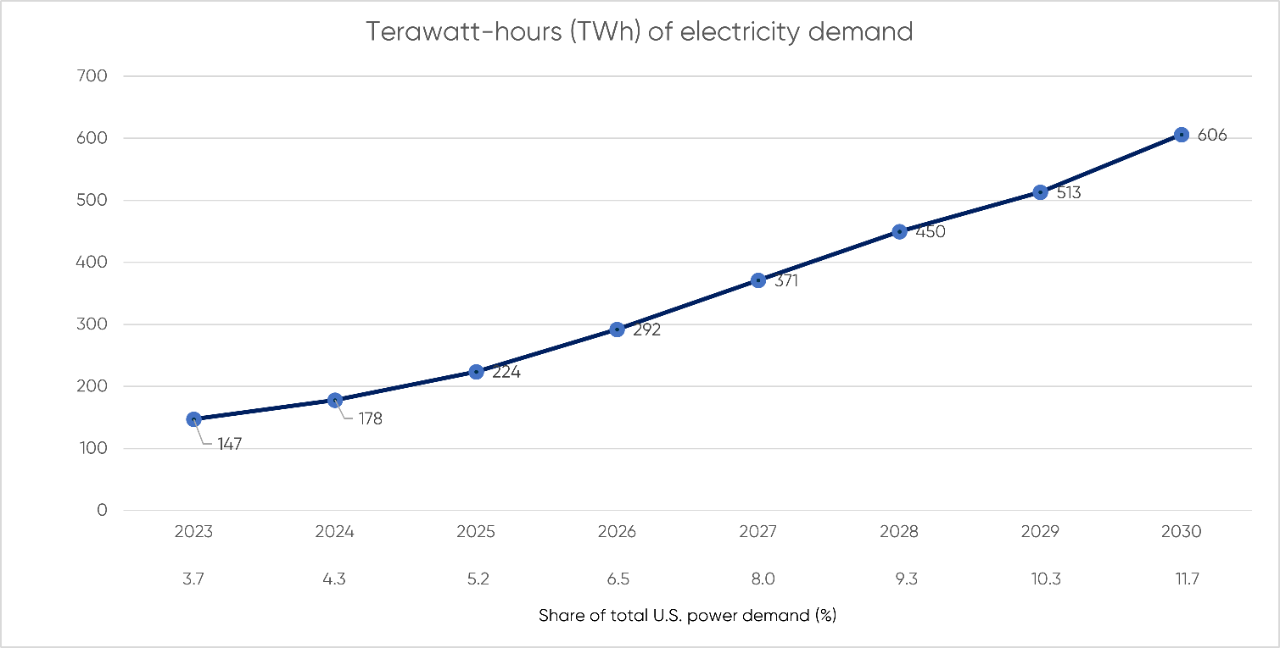

According to consulting firm McKinsey & Co., electricity demand for U.S. data centres is expected to surge by over 400 terawatt-hours (TWh) between 2024 and 2030 (Figure 2), a roughly 240% increase, making the U.S. the fastest-growing market in terms of data centre-driven demand for power. A leap of this magnitude would follow decades of nonexistent gains in U.S. demand growth for electricity, translating into a need for substantially more power-generating assets.

Data centre demand for electricity is expected to surge

Source: McKinsey & Company; Global Energy Perspective 2023, October 16, 2023

Ultimately, this unprecedented rising demand means that many regional energy markets will become much tighter, likely leading to higher electricity prices—until the supply of new power catches up with demand. Recent construction of new data centres has, not surprisingly, been concentrated in primary markets (e.g., northern Virginia, Silicon Valley, and Texas) where demand for electricity is especially strong.

But building new data centres in these areas has become more challenging due to limitations on power transmission (ranging from technical issues to regulatory approvals) which have resulted in a slower speed-to-market for new projects. We anticipate that footprints for new U.S. data centres will expand into secondary and tertiary markets in the South and Midwest—areas where companies can benefit from a more favourable development backdrop, with greater land availability and of the ability to repurpose existing brownfield infrastructure.

Heightened demand for electricity is also expected from another major source: the growing trend of “onshoring” and “nearshoring” in which U.S.-based companies with multinational operations relocate some or all of their manufacturing facilities closer to home. Continued and accelerated investment in infrastructure will be essential to enable this future growth.

Broad electrification sparks infrastructure spending

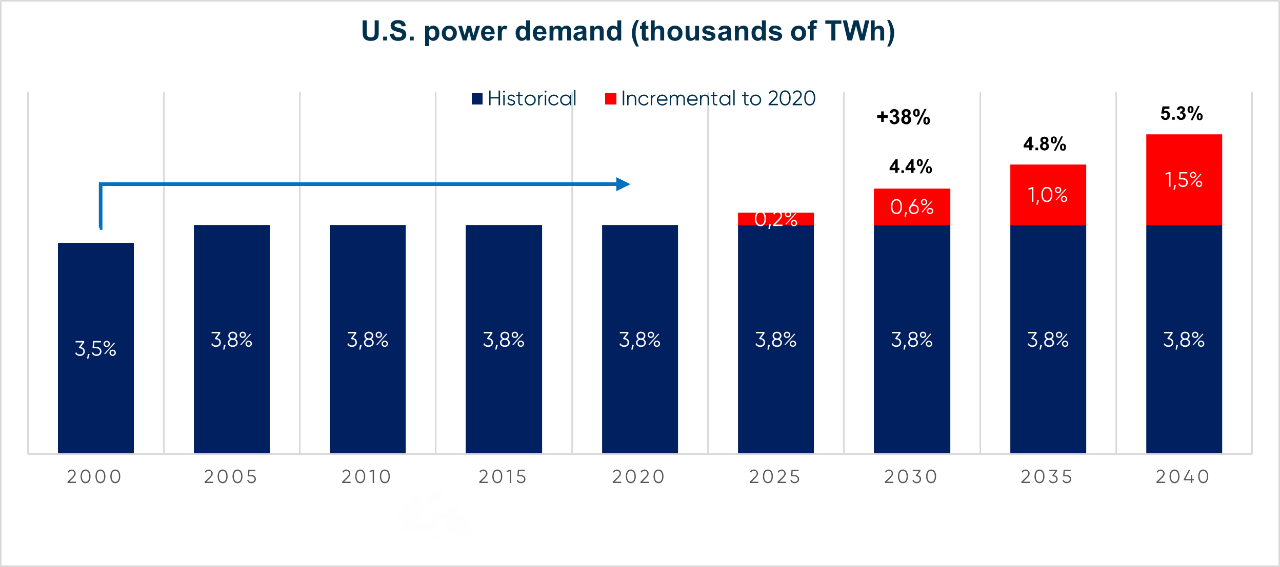

Some historical context on power demand in recent decades can help us understand where it may be headed. Over the past 25 years, the U.S. has seen only tepid growth in power demand, largely due to substantial investments in energy efficiency. Substantial capital expenditure (capex) growth will be needed to support the electric grid and bring new power-generating capacity online. We expect that continued increases in demand and infrastructure capex trends like these will ultimately drive further investment opportunities. Figure 3 below shows the scope of the change we anticipate in U.S. power demand in light of today’s mega themes.

Exponential growth in energy demand

Source: McKinsey Energy Solutions Global Energy Perspective 2024; EIA AEO 2023

Filtering out investment opportunities

In addition, we think higher capex spending will in turn spur increased growth in earnings and cash flows for the broad utility sector over the longer term. Companies with greater exposure to power generation stand to benefit the most as demand for energy rises and electricity markets tighten.

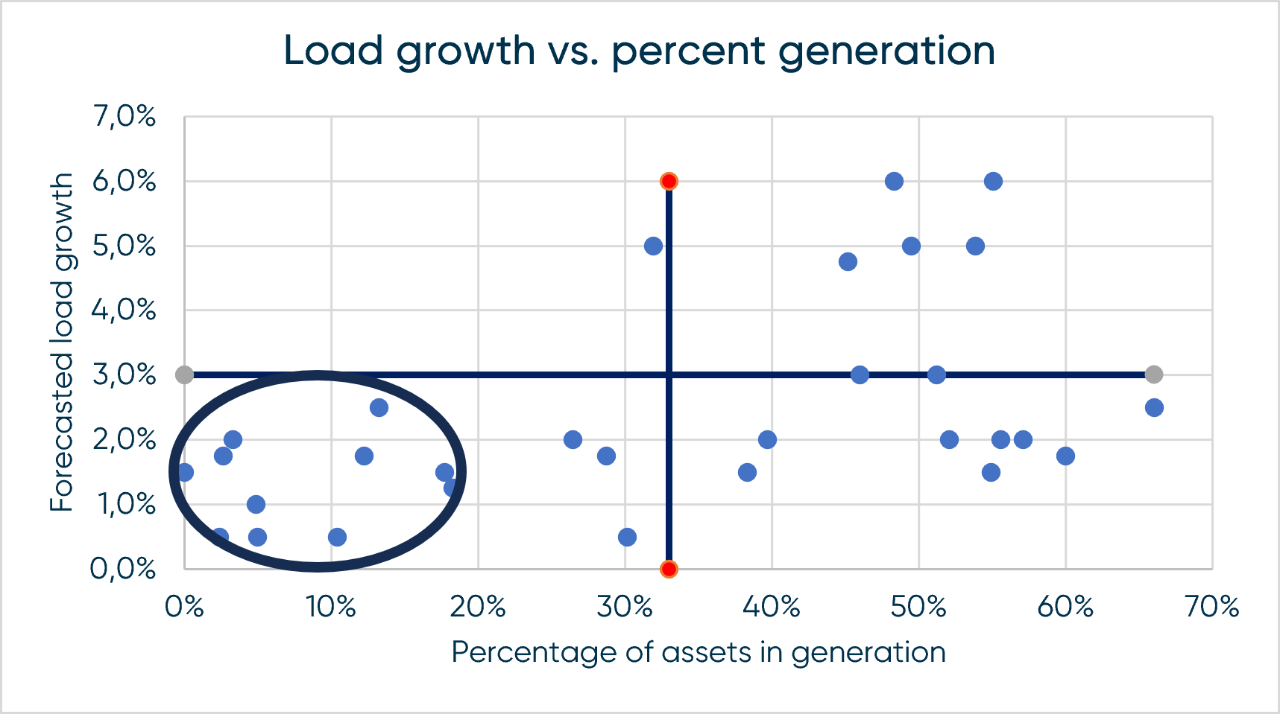

Figure 4 below plots 30 different U.S. utility companies by their exposure to electric generation (X axis) and overall growth of demand for electricity (Y axis). Those with lower generation exposure and higher transmission and distribution exposure are positioned to the left, while generation-only companies, such as independent power producers, are plotted on the right.

Assessing utility investment opportunities

Sources: Wolfe Research; Nuveen

Ultimately, the fastest growing utility companies will be those able to increase capital expenditures the most relative to their current size. For example, by investing in new power generation or refurbishing their existing electrical grid, companies can expand their investment base, thereby enhancing their long-term cash flows and earnings growth.

In our view, companies in the upper-right (northeast) quadrant are well positioned to benefit from increased demand trends, given their greater opportunity to invest in new power generation to meet the rising demand for electricity (load growth). Furthermore, power generation companies in more competitive (i.e., unregulated) markets stand to benefit as energy prices move higher.

In contrast, utilities with lower load growth and an emphasis on transmission and distribution, shown in the lower-left (southwest) quadrant, could be at a relative disadvantage in terms of incremental investment opportunities given their limited participation in building new power generation.

NBI Global Real Assets Income Fund

NBI Global Real Assets Income ETF