What is CRM3?

Client Relationship Model Phase 3 (CRM3) builds on CRM2 by introducing Total Cost Reporting (TCR), which improves transparency on embedded costs and their effect on returns.

How does it differ from CRM2?

| Category | CRM2 Report (Current) | TCR Report |

|---|---|---|

| Scope of Cost Disclosure | Shows only direct costs paid to Dealer by the investor or another registrant, such as Dealer fees, transaction costs, and trailing commissions | Direct costs have been expanded to include indirect costs of owning investment funds i.e. also reflects all embedded product costs, such as fund management fees, fund operating costs, and deferred sales charges incurred on historic holdings |

| Format of Cost Disclosure | Total direct costs in dollars | Total direct and embedded costs in dollars Adds a new requirement for the Fund Expense Ratio (FER) for each investment fund held during the reporting period. The FER represents the total percentage of a fund’s assets used to cover fund expenses on an annual basis. FER is made up of two components:

|

CRM2 reports will evolve into the CRM3 Report. Whereas CRM2 addressed dealer-paid fees, CRM3 will include all costs (TCR), such as management and transaction fees, to provide investors with a comprehensive overview of investment expenses.

| CRM2 | CRM3 |

|---|---|

| Investment Performance Report | Investment Performance Report (Same) |

| Annual Fees & Compensation Report (Additions) | |

| Annual Fees & Compensation Report | Product Fee Report (New) |

| Legal Notices (New) |

What is its main objective?

Provide greater cost transparency regarding net portfolio performance to support clear and informed discussions, helping clients understand the details of their payments.

When does CRM3 take effect?

The first annual reports that include the full cost disclosure mandated by CRM3 will be delivered to investors in early 2027, reflecting the 2026 calendar year.

What is Total Cost Reporting (TCR)?

TCR requires investment firms to show clients the total costs of owning investment funds. This includes direct fees (like commissions or trading charges) and embedded fees (like management and trading costs within funds).

What Funds are impacted by TCR?

Funds impacted by TCR include:

Mutual funds and ETFs offered under a prospectus

Split shared, closed end and guaranteed investment funds

Funds not impacted by TCR include:

Private placement

Structured products

Labour-sponsored

What are the new disclosure requirements?

CRM3 requires three types of annual statement disclosures:

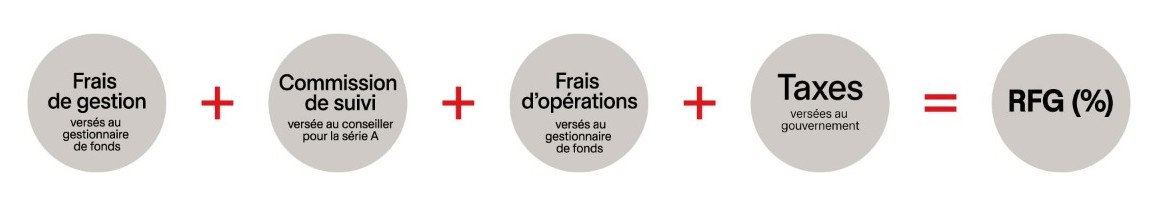

- Fund Expense Ratio (FER): a combination of MERs and TERs.

- Fund Expense Dollar Value: the dollar amount of fees paid by the investor.

- Impact on Returns: showing how fees affect portfolio performance.

What does FER stand for?

FER stands for Fund Expense Ratio (%), indicating the percentage of a fund’s assets used for operating expenses. It includes two main parts: Management Expense Ratio (MER), covering management fees and operating costs, and Trading Expense Ratio (TER), reflecting costs from trading securities within the fund.

Will performance information still be included?

Yes, the objective is to help clients see how fees impact returns. While the new rules focus on cost disclosure, advisors are encouraged to link fees and investment results for added clarity.

How can advisors prepare?

Start by reviewing the document 5 Lessons learned from CRM2 on fees with clients, which includes a checklist of key actions to help you stay ahead. It outlines how to approach fee conversations, what terms to use, and how to position FER within CRM3 reporting. Understanding this language will help you confidently explain costs and reinforce your value to clients.

For a deep dive on fees and the new Fund Expense ratio : From MER To FER

For more information on how to engage in discussions with investors on the topic of CRM3: 5 Lessons learned from CRM2 on fees with clients.