Market concentration and its risks

As global equity portfolios have become increasingly concentrated, particularly within large-cap US technology stocks, investors have enjoyed strong passive returns driven by the exceptional performance of a select few companies. However, this elevated concentration introduces substantial risks that are often overlooked.

When a disproportionate share of market performance and investor capital is tied to a handful of dominant stocks, portfolio vulnerability increases. Shifts in market sentiment, regulatory changes, or unexpected disruptions affecting these leading firms can trigger outsized volatility and losses across passive portfolios that mirror headline indices. Moreover, concentration can mask underlying sector or geographic risks, making portfolios less resilient to idiosyncratic events.

Ultimately, the shift toward greater market concentration serves as both a warning and an opportunity—a signal that investors should reconsider the balance between passive and active strategies in their pursuit of sustainable, long-term returns.

Market concentration

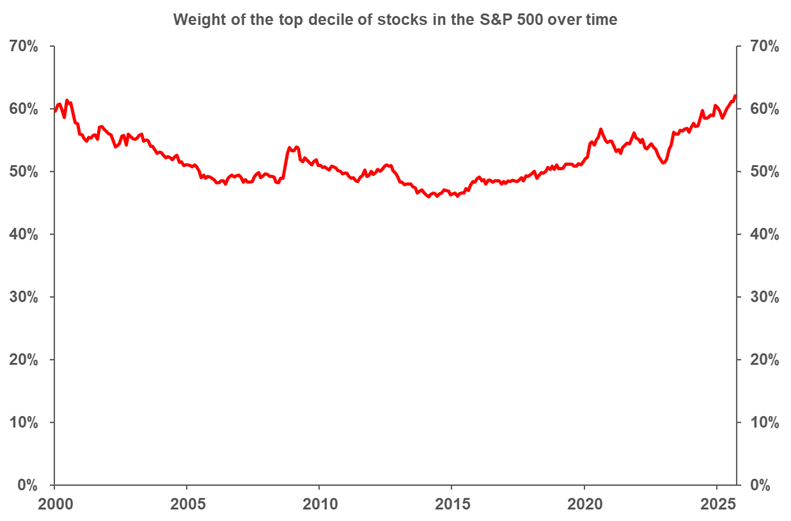

Today, the U.S. stock market is dominated by a handful of tech giants. Just ten stocks made up 36% of the U.S. market at the end of 2024, the highest level in 40 years. In fact, the top decile of S&P 500 stocks account for over 50% of the total weight of the index compared to headline indices.

Source: Morgan Stanley Investment Management; “Active management is suited to uncertain times” (May 2025).

Interest rate shifts

With interest rates rising, the environment is less favorable for companies that benefited from cheap borrowing, increasing the importance of fundamentals.

Hidden risks for passive investors

When markets are heavily concentrated, passive strategies may inadvertently expose investors to heightened risks. Should market leadership rotate or if those few dominant stocks begin to underperform, the negative impact on passive portfolios can be significant and swift. Such portfolios, by their very design, mirror the composition of headline indices—meaning that returns, volatility, and potential losses are all disproportionately tied to the fortunes of a select group of companies.

Why active management is critical now

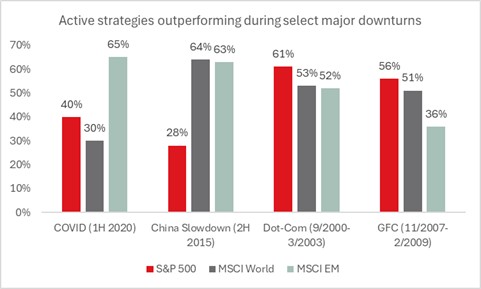

Active management offers several advantages in today’s market. In a concentrated environment, skilled active managers can selectively position portfolios to avoid overexposure to overvalued stocks and more effectively manage risk. Additionally, as higher interest rates and diminished liquidity drive greater differentiation in company performance, active managers are well placed to capitalize on stock-specific opportunities.

Market breadth also plays a crucial role in driving active manager outperformance. When a larger number of stocks outperform the average, active managers have historically excelled.

Source: NBI. Morgan Stanley Investment Management; “Active management is suited to uncertain times” (May 2025).

Determining what sets leading active managers apart

Leading active managers set themselves apart through expansive research capabilities and a commitment to in-depth analysis. Their bottom-up, research-driven strategies, guided by a structured multi-year return framework, allow them to identify the most promising investment opportunities in a complex market landscape.

A culture rooted in long-term thinking and collaboration between analysts and portfolio managers further enhances their performance. By tying success metrics to results measured over several years, these managers ensure decisions are prudent, forward-looking, and based on robust teamwork rather than short-term gains.