Offering some much-needed perspective on the current context

1. Pandemic disruptions and inflation:

Supply chain pressures are starting to ease, which should ultimately

allow inflation to settle lower leaving little room for upside

surprises on this front. However, the pandemic still remains a risk to

global supply chains and inflation's normalization process.

Even if an increasing number of countries are moving away from severe restrictions in their fight against the virus, this is not the case for China (which is central to global supply) and cannot afford to let the virus circulate freely.

2. A new interest rate cycle:

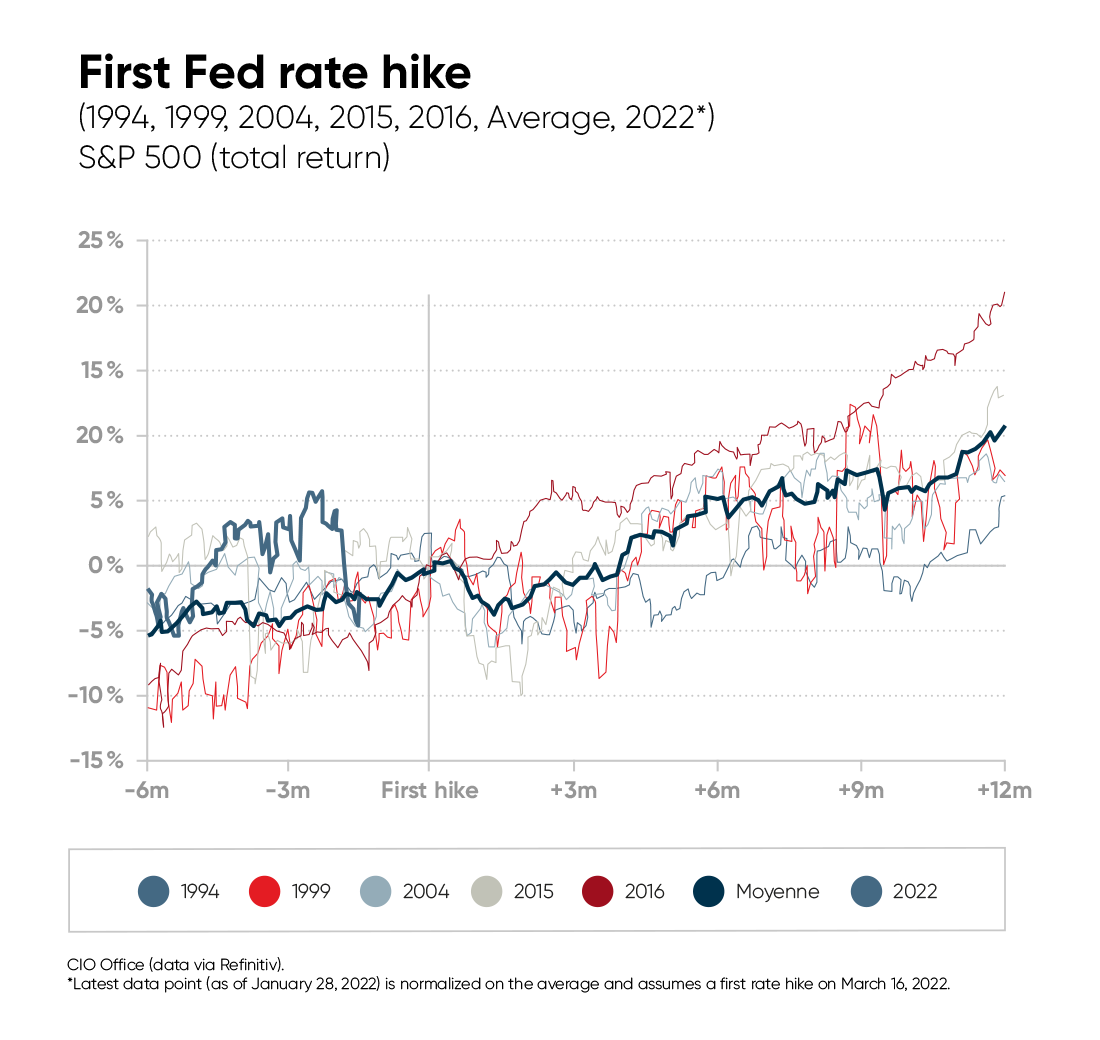

Looking back at the last 30 years, an acclimatization process whereby stocks tend to react nervously at the onset of a rate-hike cycle is not new or unusual.

History has shown U.S. stocks were usually quite volatile in the months following the first hike. However, at the end of the 12-month horizon, total returns were always in positive territory (see the following chart).

3. Geopolitical risks:

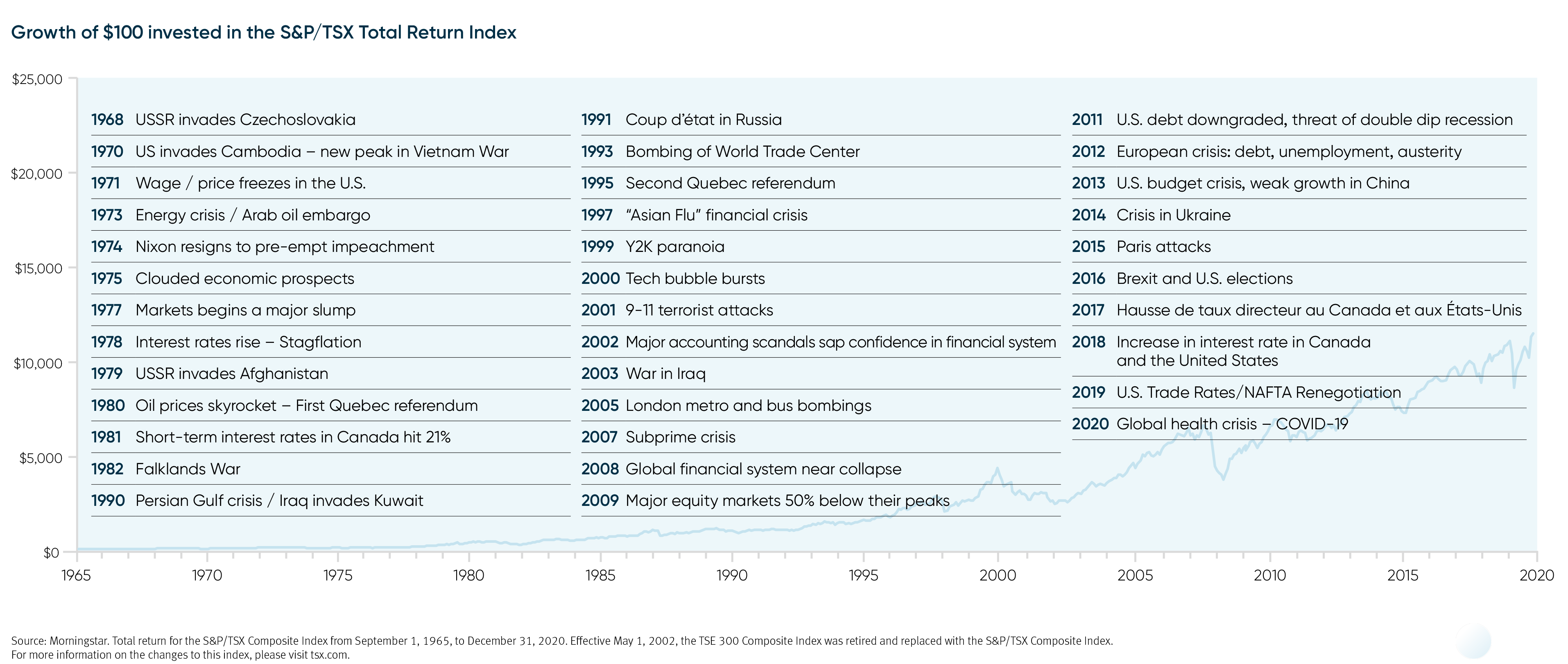

With regards to Russia and Ukraine, there is no guarantee things won't deteriorate further in the near term. However, the chart below should serve as a reminder that markets historically tend to trend upwards over the long term (despite momentary dips during crises).

Quick tips to help keep your emotions in check

As a general rule:

- Stay focused on a long-term goal to help overcome temporary setbacks in markets.

- Avoid panic selling as it often rhymes with selling low and missing the rebound.

- Mitigate volatility by investing in a diversified portfolio of asset classes, all of which react differently to evolving market conditions.

Offsetting market volatility with alternative asset classes

Investments will always be subject to the whims of market ups and downs and different types of assets in a portfolio do not undergo the same fluctuations.

Frequently, bonds are up when stocks are down. The more investors diversify the types of assets in their portfolios, the more they reduce the risks associated with market fluctuations. Using alternative strategies can help diversify exposure even further due to their lower average correlations with traditional investments.

NBI Liquid Alternatives ETF (NALT)

NBI Liquid Alternatives ETF (NALT) is a strategy that takes advantage of market trends while aiming for maximum decorrelation with equities. As such, NALT seeks to lower volatility while aiming to provide positive returns.