Adding alternatives to the mix

Given the changing economic landscape, money managers are focusing on a broader allocation to achieve long-term growth with a reasonable level of risk. Institutional investors are relying more than ever on alternative investments such as hedge funds, commodities, real assets, and private equity to build well-rounded portfolios. In fact, recognizing the benefits they provide, many Canadian pension plans have decidedly turned to this asset class in their portfolio construction.

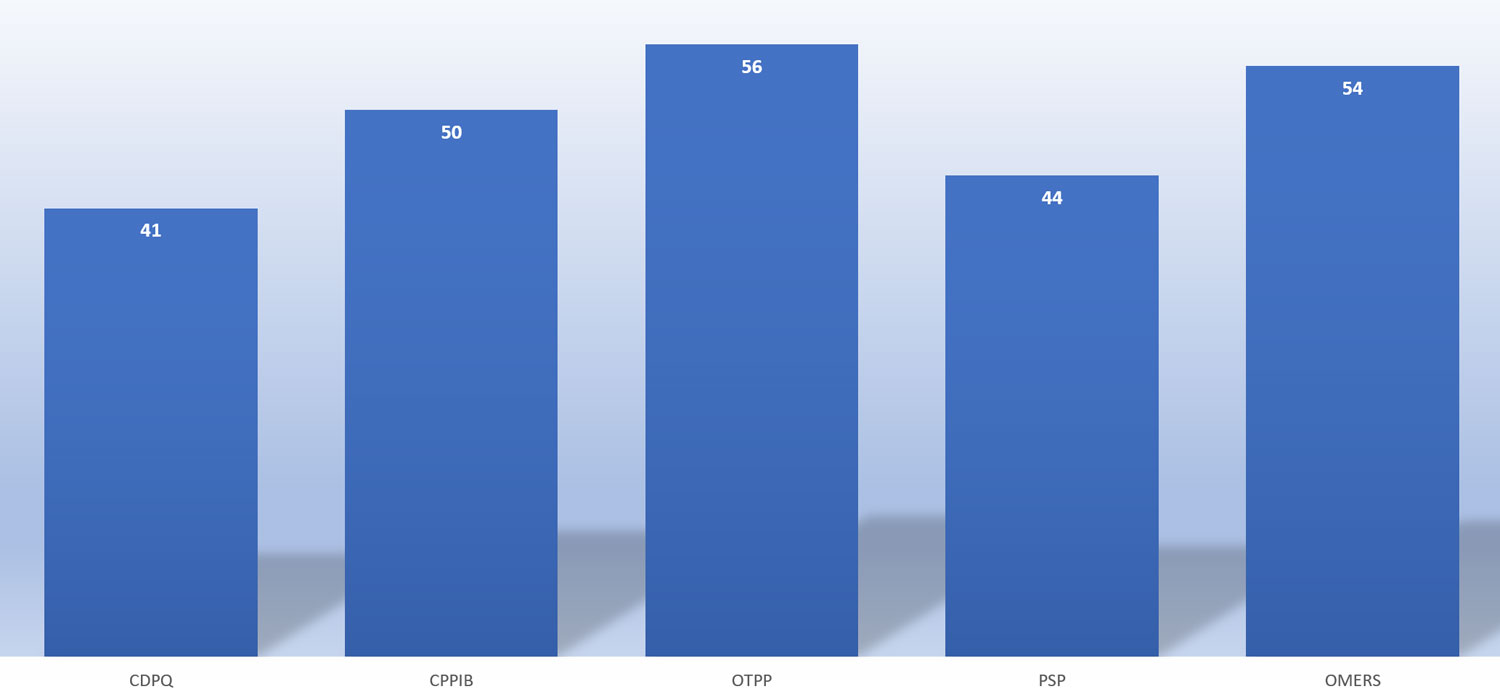

Alternative Investments as a Percentage of Pension Plan Assets

CDPQ and OTPP data as of December 31, 2021

CPPIB and PSP data as of March 31,

2022

OMERS data as of June 30, 2022

Source: NBI

Offsetting market volatility with alternative asset classes

Myriad strategies comprise alternative investments and they can play different roles in portfolio construction. As a tool to diversify away from public equity and fixed income securities, they can complement traditional asset classes through differentiated sources of returns.

While stocks generally suffer in a recessionary environment, bond prices usually rise when central banks lower interest rates to bolster the economy. The inverse correlation tends to cushion overall returns and help curb volatility. This typical scenario, however, has not always held true during times of high inflation.

For instance, the early 1970s saw a period of loose monetary policies, generous fiscal stimuli, and energy supply disruptions that sparked a decade of stagflation. Is history repeating itself? Both stocks and bonds can decline if hawkish central bankers hike interest rates to rein in runaway prices. As a result, a classic 60/40 balanced portfolio may not provide the same degree of downside protection it has in the past.

The uncertainties of today’s market environment are the new normal. Integrating alternative investments into a traditional portfolio will potentially reduce volatility and allow for protection in down markets while still offering exposure to growth. Although the notion of diversification is nothing new, taking the road less travelled by adding these types of assets to their portfolio can help investors navigate sometimes difficult markets and reach their objectives over the long term.

The NBI Liquid Alternatives ETF (NALT) figures among the alternative investments you may consider.

NALT implements a Systematic Global Macro investment strategy.

- The portfolio is composed of long and short futures contract positions.

- Quantitative models determine the allocation and NBI specialists then review these choices.

- Their application aims to maintain a low correlation with stock markets and to control risks.