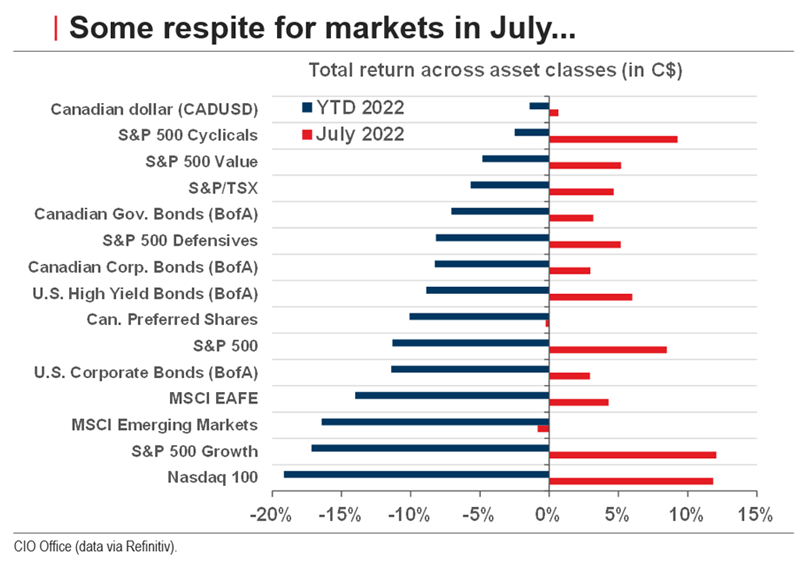

After months of losses for both stocks and bonds, investors finally enjoyed a break as most assets ended the period with gains.

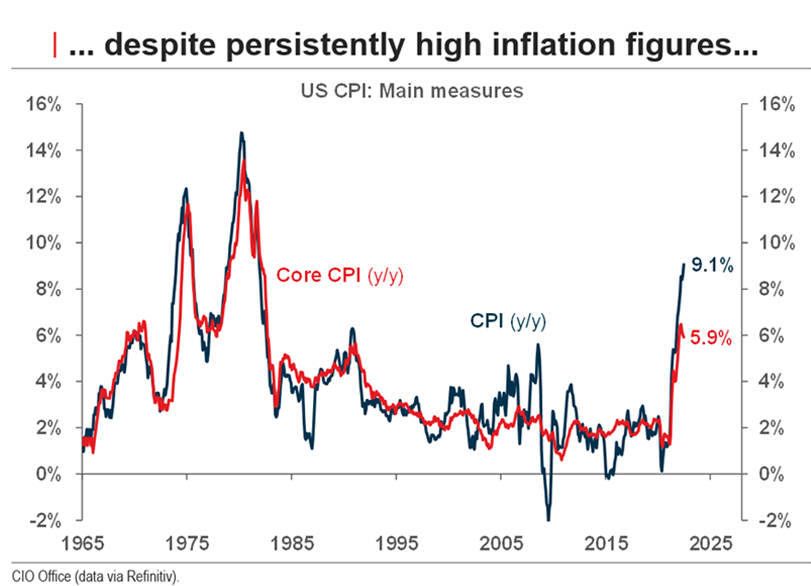

Yet, central banks continued to quickly hike their policy rates based on the most recent inflation figures.

It is not uncommon to see counter-trend rebounds when investor pessimism and oversold conditions reach extreme levels, as was the case for both stocks and bonds. There is also the fact that inflation figures are, first and foremost, a reflection of the past, while the markets are discounting machines focused on the future. And, in this regard, expectations are shifting quickly.

One side-effect of a strong US dollar

In addition, the impact of a relatively strong US dollar compared to other international currencies can be seen with the US Federal Reserve increasing interest rates faster than many other central banks. That in turn has consequences for some international companies who are bringing overseas profits back to the United States. A relatively strong dollar translates to international profits that are worth a little bit less, which acts as a headwind in terms of short-term profitability.

Interpreting the clouds

The impact on share prices is much more diverse, and partly due to expectations. As Global equity markets tend to be forward looking, they have weakened, and so to an extent, some of these negatives have already been anticipated in share prices. Therefore, this confirmation of negative news is actually being taken as a positive as it is reducing uncertainty.

From an investor's point of view, this is quite a healthy and positive dynamic as it suggests we are moving through this period of uncertainty. It should be welcomed by those who are thinking about the medium and longer term and what life could look like after this current period of economic weakness. Staying invested through market downturns and maintaining a diversified portfolio is a tried-and-true approach to weather market storms.

See below for two of our featured solutions among the NBI Funds that could help you diversify your portfolio.

NBI

Canadian Equity Growth Fund

The fund aims to provide

investors with superior investment returns over the long term, having

regard for the safety of capital. The fund invests in a diversified

portfolio of primarily Canadian equities. It is expected that

investments in foreign securities will not exceed approximately 49% of

the fund's net assets.

Jarislowsky

Fraser Select Income Fund

The fund's investment objective

is to provide regular income and to achieve moderate capital growth by

investing, directly or indirectly, in a diversified portfolio

comprised primarily of Canadian fixed income and equity securities.

The fund may invest approximately 30% of its assets in equity or

fixed-income securities of foreign issuers.