Setting the appropriate asset allocation for retirement

While there is no one-size-fits-all approach, retirement investment portfolios should be diversified according to each individual’s risk tolerance and time horizon. Younger folks who are far away from retirement generally have more leeway to buy growth-oriented equities. The reality is, given their longer investment horizons, they have more chance to recover if the stock market undergoes corrections. Typically, as individuals get closer to retirement, they should gradually decrease their exposure to equities and move towards “safer” fixed-income assets, which should ideally provide sufficient returns to counter the long-term effects of inflation.

Adapting retirement portfolios to current market conditions

Combining equities and bonds in retirement portfolios by allocating them accordingly to each investor’s profile, has been fruitful over the last decade, with bond prices benefitting from the falling interest rate environment and equities reaching all-time highs. But as markets continue to evolve, adding alternative investments such as real estate, private equity and loans is also an option, as they are uncorrelated to traditional equities and fixed income, and may even provide additional income.

Facing the headwinds of a “lower for longer” interest rate environment, enhanced volatility and potentially inferior returns relative to previous years, some investors may need to readjust their retirement plan, chose to save more and even postpone their retirements.

However, before rethinking one’s retirement plan, it is important to consider the following:

- Ensure that the investment strategy matches the goals, risk profile and return targets to make sure that savings last through retirement

- Stay focused by avoiding emotional reactions and hasty decisions during periods of high volatility

- Diversify investments to make capital last

- Tactically readjust to minimize impact, maintain income flow and benefit from opportunities

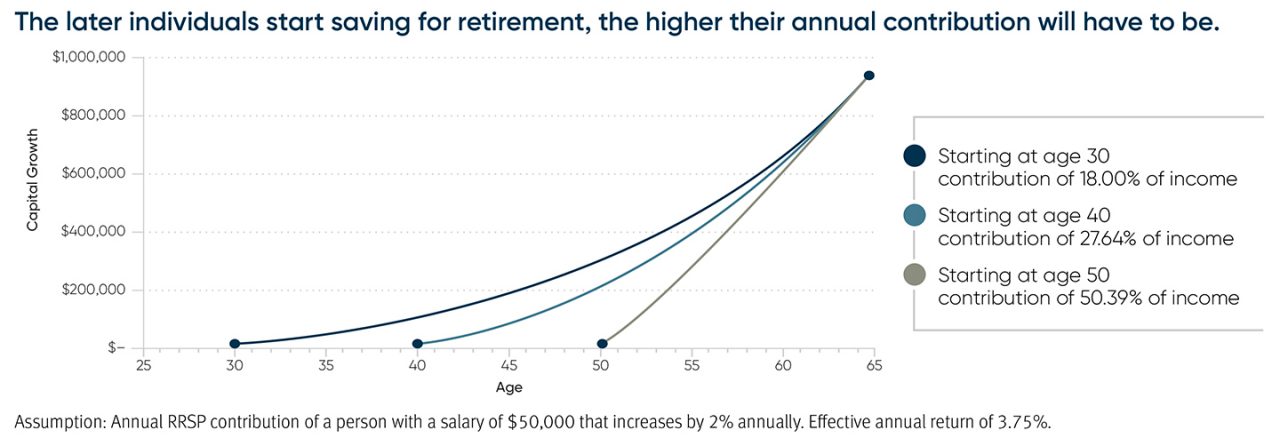

- Last but not least, start saving early. It will pay off in the long run!

Get ready for RRSP season

Did you know?

- 6 out of 10 Canadians never or rarely maximize their monthly RRSP contributions according to the eligible amounts.1

- While 72% of Canadians, and 47% of people age 50 and over, acknowledge that they’ve saved a quarter or less for their retirement2, the age of retirement (61 years old) has not changed since 20173.

- Half of Canadians think they still need at least $1M to retire4.

- The fear most commonly cited by workers age 50 and over is using up their savings before dying5.

Retirement is an important life stage; many are not adequately prepared for it. In order to preserve the same quality of life during retirement, about 70% of the annual individual’s pre-retirement income is suggested by many experts. Some may need more or less, depending on their future projects. Starting saving early will prevent individuals from having to work twice as hard when getting closer to retirement. By setting money aside in RRSP and/or TSFA (through pre-authorized monthly contributions rather than a large one at the end of the year/March deadline) interest accrues tax free each month, on every dollar invested, without undue pressure on budget.