Benefits of unconstrained investing

While there are still opportunities in the traditional fixed income space, unconstrained fixed income investing can help provide better risk-adjusted returns and flexibility, regardless of market conditions.

Reasons to incorporate an unconstrained strategy

- Not bound by traditional benchmark-specific guidelines

- Access to a broader investment universe

- Added diversification and low correlation to traditional bonds and equities

- Greater flexibility to adjust to changing markets

- Focus on capital preservation during challenging periods and generating alpha regardless of market conditions

What if interest rates rise?

For the moment, major central banks such as the U.S. Federal Reserve and the Bank of Canada have reverted to a more accommodative stance. But what if the paradigm shifts from lower to higher interest rates? As depicted in Chart 1, unconstrained strategies have delivered returns in excess of the Barclays Aggregate Index* in periods of rising or stable rates.

Source: J.P. Morgan Asset Management, Bloomberg. Unconstrained Fixed Income Fund is the gross of fee performance for the US Global Bond Opportunities Mutual Fund. Shown for illustrative purposes only

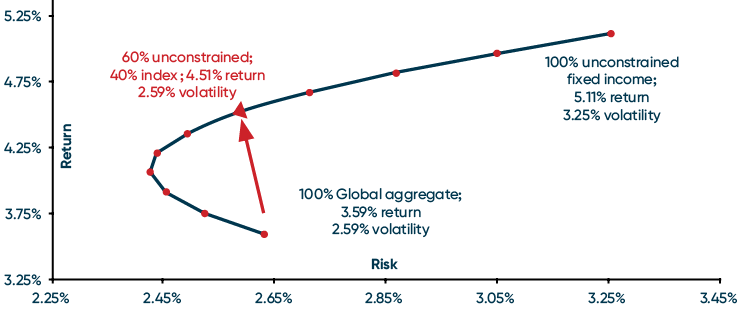

Using an unconstrained strategy to complement a traditional portfolio

Traditional bonds have limited leeway when it comes to enhancing yield, improving diversification and managing interest rate sensitivity. They have also been shown to be less efficient during rising rates and volatile periods. Regardless of interest rates, adding an unconstrained strategy to a traditional fixed income allocation can also improve an investor’s risk-return trade-off, as shown below.

Source: J.P. Morgan Asset Management, Bloomberg Barclays; October 2011 to December 2019. Unconstrained Total Return is represented by the JPMorgan Global Bond Opportunities Fund and the Aggregate Index is the Bloomberg Barclays US Aggregate Index.