Growth drivers…

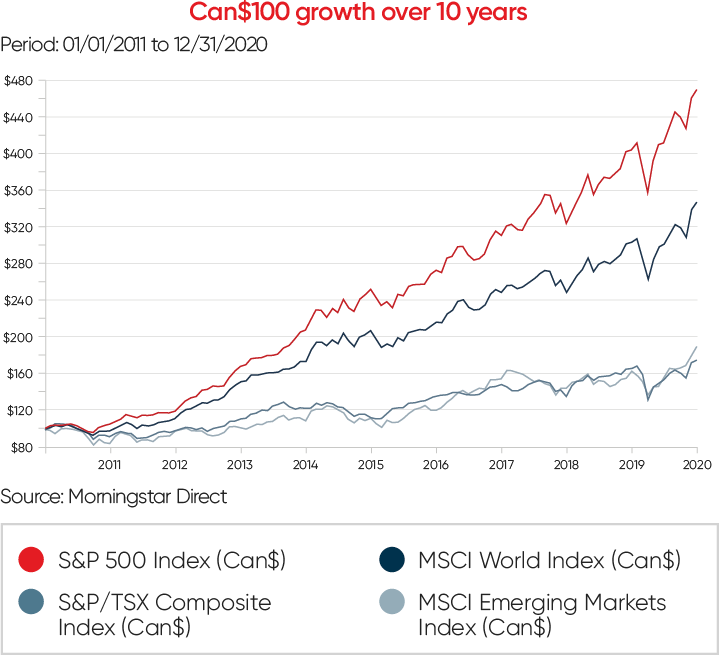

Over the past 10 years, few stock markets have outperformed the U.S., where several sectors have experienced double- or even triple-digit growth.

For example, an initial amount of Can$100 invested in the S&P 500

Index at the beginning of 2011 was worth around Can$470 a decade

later, as the graph below shows. This is an enviable total return of

approximately 370% or an annualized average of 37%.

Elsewhere in the world, several key indices have not performed as well over this period. For example, an investment in the MSCI Emerging Markets Index (Can$), which includes China’s dynamic economy, underperformed in the S&P 500 between 2011 and 2020.

… may change!

In the short to medium term, the world’s largest economy is likely to

enjoy a sharp rebound once the pandemic is under control, thanks to an

ambitious US$2 trillion stimulus package and consumers eager to start

spending and travelling again. A similar recovery appears to be

emerging for Canada.

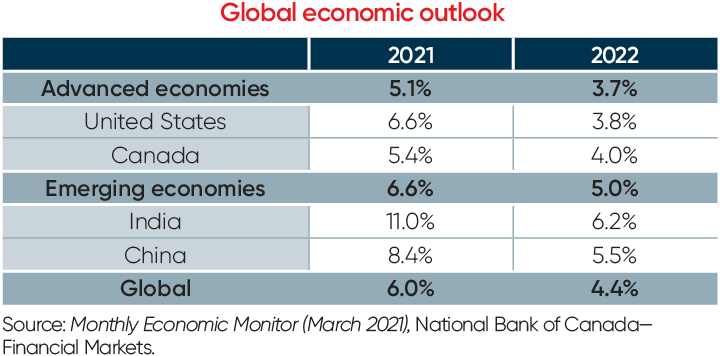

However, will U.S. stock markets continue to drive returns? As the table above shows, the future looks more nuanced. Important points worth thinking about:

- United States: Many large-cap U.S. stocks, particularly in the technology sector, are trading at all-time highs.

- Eurozone: Like the United States, Europe is home to several large, well-established companies with global revenues that are trading at better prices.

- China: China’s giant market is expected to continue to drive global growth this year, supported by strong foreign demand for its products. There are a growing number of new-economy companies, joining the likes of Alibaba, Tencent and TikTok.

In the longer term, a number of demographic and economic indicators favour emerging markets: a young, increasingly educated and urbanized population, which is swelling the ranks of a middle class hungry for goods and services.

Time for diversification

It’s a well-known fact that sound portfolio diversification helps to improve performance while mitigating risk. And over the next few years, that diversification seems to include greater international exposure:

- Several developed international markets offer lower P/E ratios.

- In addition, “emerging and developing economies will continue to see the highest rate of growth,” according to the Long-Term Market Expectations 2020–2025 from NBI’s CIO Office.

Mutual funds and ETFs are the best way to harness their potential. By

definition, these solutions are much more diversified and less subject

to market moods than individual stocks. The ability to increase

international exposure provides investors with one more tool to help

them achieve their financial goals.