The case for Canadian equities

As investors contend with the seemingly endless stream of news stories and market events, how Canadians think about domestic equities as part of their overall portfolio has become top of mind. What started a few years ago with a discussion around decreasing home bias in Canadian portfolios has taken on new meaning in 2025 as investors evaluate where to allocate in the current environment. From Fiera’s perspective, the investment case for Canadian equities proves stronger than ever.

The strength of short- and very long-term returns in Canada

Despite making up only a small portion of the global equity market, Canadian stocks have been some of the strongest performers to date this year, with the S&P/TSX outperforming both the S&P 500 and MSCI World indices. This isn’t a recent phenomenon, however, as the TSX has also beaten the MSCI World on a 5-year annualized basis which covers the post-pandemic bull market that includes the emergence of AI as well as the “Magnificent Seven.” Through all this, Canada has kept up.

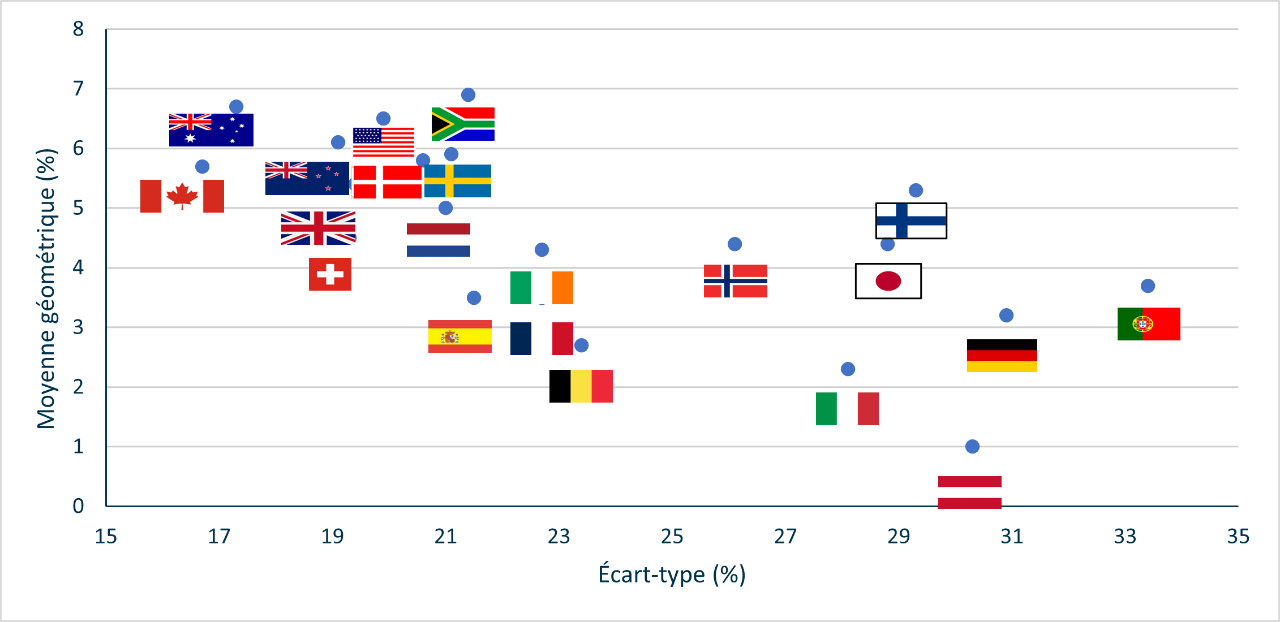

What about longer time frames? According to the UBS 2024 Global Investment Returns Yearbook—which tracks various countries’ equity market return data going back more than 100 years—Canada has the 7ᵗʰ strongest mean real return and the #1 lowest standard deviation out of 21 developed countries from 1900 to 2023. As a result, Canada has the second-highest level of return per unit of risk (mean/standard deviation) over that period, just behind Australia. Interestingly, public pension plans in that latter country have historically allocated more than 50% of their equity portfolios to domestic stocks.¹

Real equity returns worldwide from 1900 to 2023

Source : Global Investment Returns Yearbook 2024, UBS Investment Bank

Beyond absolute returns, investors must also take into consideration the benefits of active management. If there’s one thing the last number of years has shown, it’s that alpha is scarce and can depend on the market. According to Global Manager Research’s April 2025 Institutional Performance Report, the median U.S. equity and global equity managers did not beat their respective benchmark for the annualized 5-, 7-, and 10-year periods, while the median Canadian equity manager did. It seems like it’s easier to generate alpha in Canada than in more challenging U.S. and global markets.

A better place to invest?

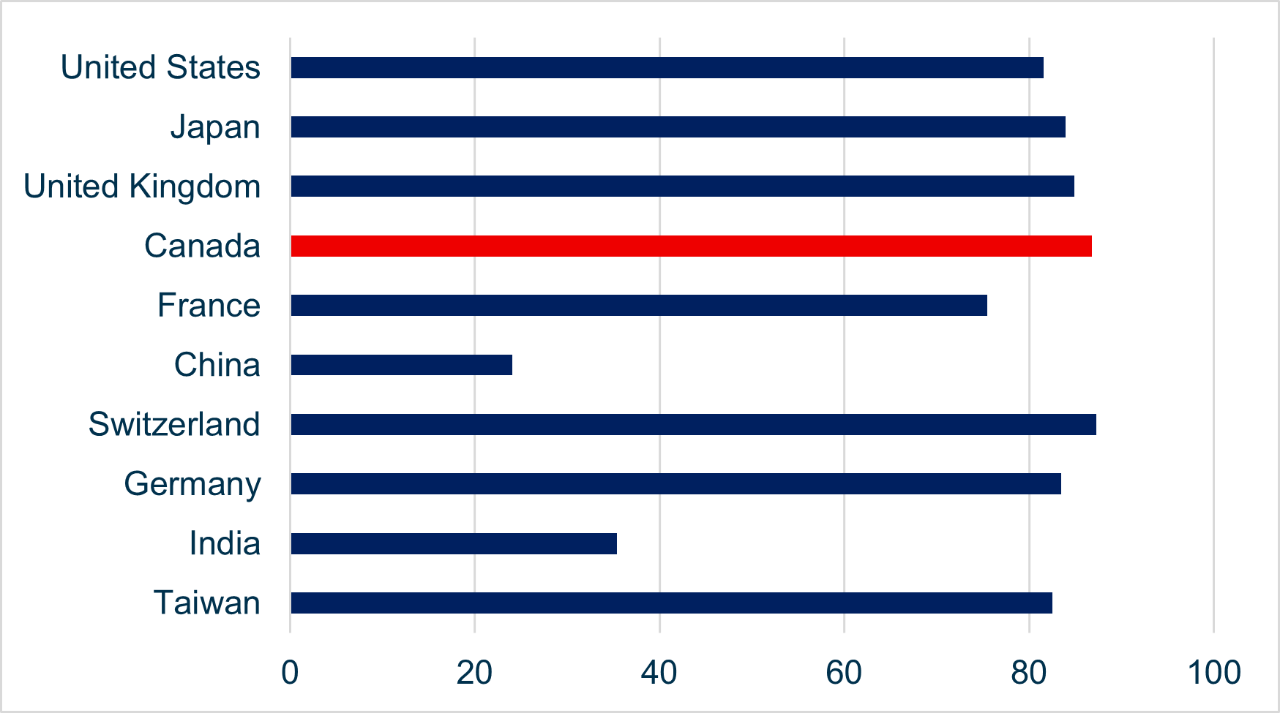

Another consideration for investors is understanding the regulatory risk associated with global markets and incorporating this factor into any assessment of a potential strategy or investment. Out of the top 10 countries by weight in the MSCI World Index, Canada boasts one of the highest regulatory quality scores as determined by the World Bank. This measure reflects perceptions of a government’s ability to formulate and implement sound policies and regulations, and their impact on private sector development.

World Bank regulatory quality score (2023)

Source: Worldwide Governance Indicators, 2024 Update, World Bank (www.govindicators.org)

More than just oil and gas

Historically, Canada has been characterized as an overconcentrated market in which a few key sectors such as Energy, Materials, and Financials dominate both share of market and returns. This is a misrepresentation of the Canadian stock market that deserves further investigation.

Sector classifications are just another label. Segmenting the market creates easy to understand discrete groupings—think of Energy or Utilities or Industrials. Companies are assigned to sectors and subsectors (and further subsectors) according to their principal business activity. In Canada, the Global Industry Classification Standard (GICS) is the prevailing taxonomy, and it exists because certain end users find value in it.

In some cases, it allows participants to describe the evolution of the market. What’s the next big thing, or where is interest waning? As an example, the Energy and Materials sectors represented almost a third of the S&P/TSX Composite weight at the end of 2024. Fifteen years ago, it was closer to half. Furthermore, sector returns don’t paint the whole picture of the market. In 2021, the TSX rose by a record 25% led by the top-performing Energy sector which was also the second largest. The following year, the TSX fell by 6% during which the top-performing sector was once again Energy.

The case for Canada has never been stronger

The NBI Sustainable Canadian Equity Strategy’s goal is to build a portfolio of high quality, attractively valued companies that are committed to sustainable business practices in how they interact and engage with their clients, employees, communities, and the environment. The strategy excludes the Energy and Utilities sectors from the investable universe but has nonetheless shown an ability to provide strong long-term performance within the Canadian equity asset class on both an absolute and relative basis.