NBI Strategic U.S. Income and Growth Fund

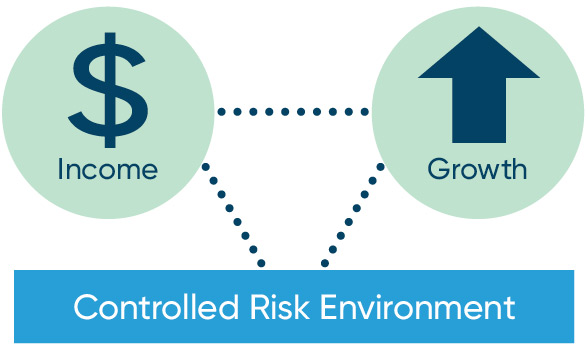

Multi-layered approach to risk management

Managed by Goldman Sachs Asset Management LP

- A dynamically managed strategy that seeks to add value on four levels: asset allocation, security selection, asset selection (making an active decision on how to gain exposure to a company within its capital structure) and duration management.

- GSAM's "Best Ideas, Go Anywhere" integrated approach allows for investment opportunities across the full "yield continuum" of equities and bonds, in both traditional and non-traditional asset classes.

- Balanced U.S. focused approach, tactical in nature, with currency risk management in the fixed income allocation.

Why invest in this Fund?

- Access to the largest bond market in the world

- Access to some of the best dividend payers

- Access to non-traditional sources of income

Exposure to the U.S.

- Exposure to the largest economy in the world

- Broadening of investment horizon

Balance between bonds and equities

- Avoiding the asset mix decision

- Multiple sources of income

About the portfolio manager's firm

- Goldman Sachs Asset Management L.P. is one of the world's leading investment managers

- USD 1.02 trillion in assets under supervision spread across a broad product offering

- Over 2,000 professionals providing extensive experience and deep bench strength

- Presence in 33 locations around the world enabling continuous sourcing of leading professionals and enhanced research efforts

Advisor Series |

H Series |

F Series |

FH Series |

T5 Series |

F5 Series |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Initial sales charge |

Low sales charge |

Deferred sales charge |

Initial sales charge |

Low sales charge |

Deferred sales charge |

Initial sales charge |

Low sales charge |

Deferred sales charge |

|||

Advisor Series |

Initial sales charge |

|

|---|---|---|

Low sales charge |

||

Deferred sales charge |

||

H Series |

Initial sales charge |

|

Low sales charge |

||

Deferred sales charge |

||

F Series |

||

FH Series |

||

T5 Series |

Initial sales charge |

|

Low sales charge |

||

Deferred sales charge |

||

F5 Series |

||

Learn more about series*

Learn about other investment solutions

NBI Unconstrained Fixed Income Fund

This Fund uses a non-traditional unconstrained fixed income strategy, allowing it to better react to market fluctuations while focusing on absolute returns and risk management.

NBI Global Tactical Bond Fund

The Fund is made up of high-quality global bonds, which provide more opportunities to generate added value and are not correlated with other classes of fixed income assets.

Questions?

Contact your NBI Sales Representative

Legal notes

The National Bank Strategic U.S. Income and Growth Fund (the “Fund”) is offered by National Bank Investments Inc., a wholly owned subsidiary of National Bank of Canada. Goldman Sachs Asset Management acts as portfolio manager for the Fund. Commissions, trailing commissions, management fees and expenses all may be associated with investments in the Fund. Please read the prospectus of the Fund before investing. The Fund’s securities are not insured by the Canada Deposit Insurance Corporation or by any other government deposit insurer. The Fund is not guaranteed, its values change frequently and past performance may not be repeated.